No Need for Nissan? Hon Hai Buyout Not in the Cards

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Thinking of AI, Not Autos

Japan’s manufacturing industry is paying close attention to Taiwan’s Hon Hai Precision Industry Co. There are theories that it may acquire the struggling Nissan Motor, while other information indicates it may begin supplying electric vehicles to Mitsubishi Motors. The conflicting information in these stories comes from a general misunderstanding of Hon Hai’s business model and the business environment in which it operates, focusing only on those elements which touch on Japan. It should be made clear, though, that Hon Hai’s primary business concern is not acquiring Nissan but expanding its AI server business.

“The truth is that growth in fiscal 2024 was much stronger than forecast in March last year. That comes as a result of efforts by all our staff,” said Young Liu, chairman of the Taiwanese powerhouse, in a powerful statement kicking off a March 14 online report of financial results.

Hon Hai Chair Young Liu speaking to the press after the company’s May 2024 General Meeting of Shareholders. (© Yamada Shūhei)

Hon Hai is the world’s largest contract manufacturer of electronics equipment, operating under the name FoxConn. That day, the company announced that total sales for the period ending December 2024 were up 11% year-on-year, a total of NT$6.86 trillion (approx. ¥31 trillion), the highest result ever. Net profits were up 7% to NT$152.7 billion, another new record, and earnings per share reached NT$11.01, the highest return since 2008.

In its EMS, or electronics manufacturing services, business, Hon Hai manufactures the IT equipment sold under other companies’ brands. For example, it manufactures roughly 60% of the iPhones sold by the US company Apple. However, this segment is largely a black box, with few opportunities for its work to be brought into the light of day aside from these annual reports.

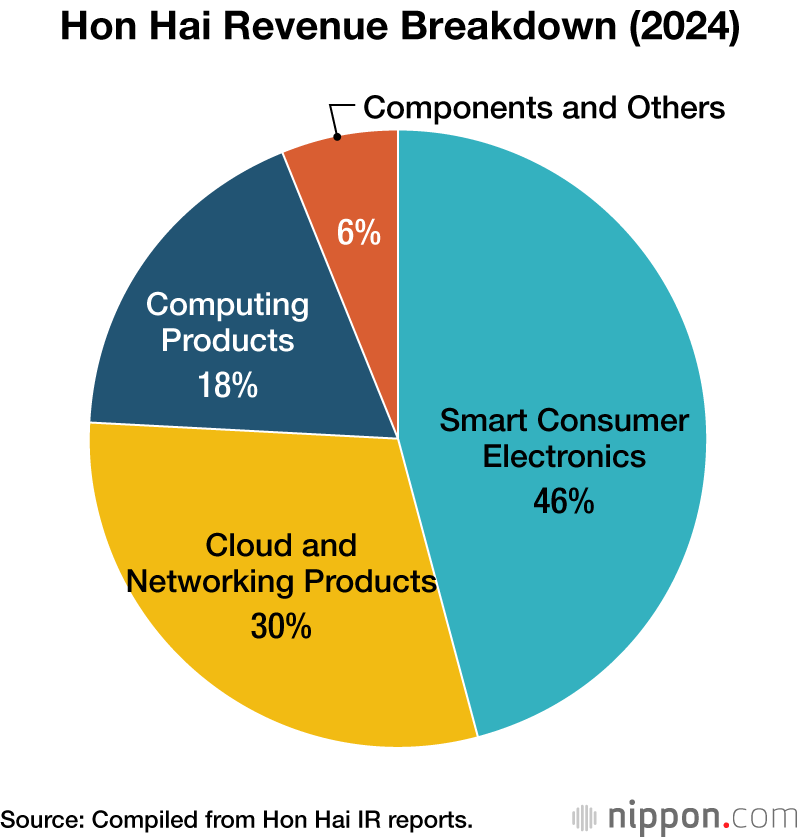

Looking at the December 2024 revenue results broken down by product, we get a sense of its positive position, though. Roughly 46% of the revenues were brought in by Smart Consumer Electronics, which includes smartphones, followed by Cloud and Networking, which includes AI servers, at 30%. However, the December 2023 figures were 54% for Smart Electronics and 22% for Networking, showing how the gap has closed in the past year.

A Generative AI Boom for Hon Hai

The global boom in generative AI has driven an enormous spike in Hon Hai’s AI server manufacturing, which uses cards from companies including Nvidia. AI servers specialized for deep learning and reasoning consume lots of power and generate massive amounts of heat, requiring high levels of technical skill for power management and liquid cooling. That gives Hon Hai room to show off its advantages.

Friction between the United States and China in the high-tech sector and resulting export controls are creating headwinds for Hon Hai’s Chinese rivals in EMS, making it hard for them to carve out larger chunks of the global AI server business. In his December announcement, Liu noted that his firm would do its utmost to hold at least 40% of the global AI server share. And, true to his words, Hon Hai has focused its management resources on that segment.

Hon Hai’s AI servers have seen a sharp increase in demand. (© Yamada Shūhei)

Roots in Black and White TVs

Hon Hai was founded in 1974 by businessman Terry Gou as a small workshop making plastic tuner knobs for black and white televisions. It later expanded into connectors and other electronic modules, eventually growing into an EMS company taking orders to manufacture complete devices like computers and home video game consoles. After taking the contract to manufacture the original iPhone in 2007, it continued expanding as a smartphone maker.

In June 2019, Gou announced his desire to enter the Taiwanese presidential election in the following year, so he stepped back and passed control of the company’s semiconductor business to Liu. When Liu took over, he announced a new “3+3” strategy, combining the previous three major segments of “EV, digital health, and robots” with three upcoming technologies of “AI, semiconductors, and next-generation communication technology.”

Hon Hai was then struggling with a drop in profits due to the commodification of PCs and smartphones. That showed up in a prolonged period of falling EPS revenue starting in 2008, and Liu offered the 3+3 strategy as a way to recover. Nearly six years since he took the top position, the December 2024 announcement showed that the strategy, with its focus on AI, is bearing fruit.

At the same time, the 3+3 strategy also pushes the EV sector, and Hon Hai is calling that business model CDMS: contract design and manufacturing services. The products will remain sold under other companies’ brands, not as Hon Hai’s own EVs, but as of October 2024, the company had announced that development was already complete for eight different EV platforms including a sports SUV, a sedan, and a bus.

The plan is that Hon Hai will provide its customer business with these designs as reference to help accelerate internal development on new EVs, which Hon Hai can then manufacture on contract. In a sense, it is applying the ideas of its PC and smartphone EMS business to vehicle manufacturing.

Its electric buses began operation in Kaohsiung, Taiwan, in March 2022, but Hon Hai is already one step behind in making its mark in passenger vehicles, which it positions as its main focus. Its initial plan was to serve emerging EV companies in the United States and China, but a series of bankruptcies in that sector means that only one model has made it to the market. That is the Luxgen n7 SUV, which Taiwan’s Yulon Group began delivering in early 2024, with total sales hitting 7,121 vehicles. That falls far short of Tesla, which sold 1.8 million cars worldwide in that same year.

Hon Hai has not announced its EV business revenues, including them in the Components and Others section of the December report. That segment only covers 6% of revenues, though, so the EV business must be even smaller. With these facts in mind, we can assume that there are two facets to Hon Hai’s lack of need to acquire Nissan.

Two Reasons Nissan is Unnecessary

The first is that there is no affinity between the two companies’ automotive businesses. Hon Hai’s CDMS business only builds EVs for other companies, while Nissan has put its focus on making and selling its own branded gasoline-engine cars. Their business directions are completely different. Nissan’s market capitalization in mid-March was roughly ¥1.6 trillion, so a simple calculation shows that acquisition would require over ¥800 billion. Hon Hai may be interested in Nissan’s property, including techniques or factories emptied by restructuring, but it could negotiate for those individually.

The other side is that there is no reason to hurry in expanding its EV business. Liu spent most of his time at the report announcement talking about AI servers, while mentioning briefly that his firm was “ready to sign an agreement of cooperation with a Japanese carmaker within one to two months.” Liu further cleared up the misunderstanding in February, explaining that any relationship with Nissan would be one of cooperation, not acquisition, and that Hon Hai was also in talks with other Japanese manufacturers besides Nissan.

More Interest in AI Servers than EVs

Other reports, of Hon Hai supplying EVs to Mitsubishi, also came in response to the “within one or two months” comment. However, no analysts or financial reporters who attended the meeting asked any questions investigating these talks with Japanese companies. In fact, there were no questions at all about EVs. As the pace of adoption for EVs is falling everywhere except China, no one thinks that boosting business in this vehicle sector is a priority. That includes not only Hon Hai itself, but also those constantly monitoring financial conditions, like the Taiwanese stock market traders and the media.

Questions from analysts instead focused on Hon Hai’s plans to address things like Trump’s tariffs or changes in the AI server supply chain. Liu said that Hon Hai planned to “actively engage” with President Trump’s goal of bringing manufacturing back to the United States.

If Hon Hai has ¥800 billion to invest, it would be more rational to put that toward an AI server assembly plant in the United States. With its EV business faltering due to connections to American and Chinese startups, it still has the option of building connections with not only Nissan or Mitsubishi, but other Japanese companies like Honda, which has had trouble itself over the attempt to merge with Nissan. There is no need to take the drastic step of acquiring Nissan outright.

The EV Business CSO and Past Acquisition of Sharp

There are two background reasons that the speculation in Japan over Hon Hai acquiring Nissan has run wild. One is the presence of Hon Hai EV Business Chief Strategy Officer Seki Jun. Seki was once the number three at Nissan and joined Hon Hai in 2023. He is a key figure in the company, who apparently traveled to France from December 2024 to discuss the possibility of Hon Hai buying Nissan shares from Renault, a major shareholder, on orders from Liu.

In autumn of 2024, Seki mentioned the share purchase to some associates in the Japanese automotive industry, which seems to have sparked speculation about the acquisition. However, Seki is in the end simply an executive in the EV business and in no position to decide on the acquisition of one of Japan’s most prominent corporations. Any reports that spread the idea of a Nissan acquisition without considering Hon Hai’s operations as a whole are simply unbalanced.

Another factor driving the speculation is the fresh memory of Hon Hai’s 2016 acquisition of Sharp. Terry Gou, then chair, had expressed interest in the Sharp brand and was victorious in an M&A battle with the Japan Investment Corporation. Sharp became a subsidiary for an investment of around ¥389 billion. Along the way, Gou was publicly critical of the JIC and Japan’s Ministry of Economy, Trade, and Industry, which were worried about the leaking of technology outside of Japan. This left an impression in Japan that Hon Hai’s management style was a rough one.

Liu, however, has been public about refuting Gou’s militaristic style of management, saying in an interview with a Taiwanese financial magazine that the thing he most wanted to change was Hon Hai’s iron-fisted management culture. Gou is still the firm’s top shareholder, with just over 10% of Hon Hai’s shares, but he resigned from his directorship in September 2023. It seems shortsighted indeed to imagine a current takeover of Nissan based on the Sharp acquisition nearly 10 years ago.

Hon Hai’s EV business expansion is a medium- to long-term initiative, and there is no doubt that the company wants to turn Japanese carmakers, including Nissan, into customers as part of that. However, Japan still retains its allergy to foreign investment, and for Hon Hai to jump all the way to acquiring a Japanese company would likely nip all its other business negotiations in the bud. Hon Hai could be a powerful partner for Japanese companies in the EV field, so it would be best for everyone if the related discussions could stay based on facts, not rumors.

(Originally published in Japanese. Banner photo: Hon Hai–developed EV platforms. © Yamada Shūhei.)