End of the East Asian Miracle? A Demographic Look at Asia’s Economic Future

Economy Politics Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

An End to the Growth Relay?

The 1960s were the era of the Japanese economic miracle. In terms of the scale of its gross national product, Japan passed France in 1963, Britain in 1967, and West Germany in 1968, leaping ahead to line up behind the United States as the second most powerful economy in the world.

Progress in East Asia did not end here, though. During this time, South Korea achieved the “Miracle on the Han,” a dramatic growth spurt referencing the name of the river flowing through the capital Seoul. This was followed by the rise of the economies of Taiwan, Hong Kong, and Singapore, completing the “Four Asian Tigers” that followed Japan into industrial modernization. These also earned the name of the NIEs, the newly industrialized economies of East Asia.

Toward the end of 1978, China’s supreme leader Deng Xiaoping launched his country’s “reform and opening” policy. This marked the beginning of the Chinese economic juggernaut. In 2010, China surpassed Japan to become the world’s number-two national economy; in December 2018, Chinese leader Xi Jinping marked the fortieth anniversary of the Deng reforms with a speech hailing the previous four decades as a miraculous period that had propelled the Chinese economy from one comprising just 1.8% of the global total to one representing 15.2% of it.

It was clear at this point that the “miraculous growth” baton had passed to the next primary global economic engine. But the next runner in this relay was already starting to run out of steam.

Demographic Dominos

The Japanese government recently announced that an official total of 799,728 babies had been born in the country during 2022. This was the lowest number recorded since comparable figures began being collected in 1899, and it broke the 800,000 mark fully 11 years before estimates from the National Institute of Population and Social Security Research. Even given the downward impact of COVID-19 related trends, this was a shocking number, one described by Prime Minister Kishida Fumio as a crisis situation.

In China, meanwhile, births in 2022 broke through the 10 million level to hit 9.6 million. The nation saw a slight climb in its birthrate in 2016, the first year after the cancellation of the “one child policy,” but since then has trended downward. The country’s population as of 2022 was 1.41 billion, falling by 850,000 from 2021.

For China, this was the first annual population drop since 1961, when the failures of the “Great Leap Forward” five-year plan triggered mass starvation deaths. Yi Fuxian, a researcher at the University of Wisconsin–Madison, notes that this was likely the first time for China’s annual births to fall below 10 million since the Qing Dynasty year of 1790. (Yi also believes that population numbers from the Chinese government are less than trustworthy, and that the probable peak was some 1.28 billion in 2018.)

South Korea in 2022 recorded an all-time low in its fertility rate—the number of children an average woman could be expected to bear during her lifetime—of just 0.78. This gives Korea the most dramatic rate of childbirth decline in the world, at less than 40% of the 2.1 children per woman that could be expected to maintain the population at its current level. It should be noted that the Korean government was not unaware of this ongoing crisis—from 2006 through 2021, it spent some 280 trillion won, or around ¥28 trillion, on measures to combat the plummeting childbearing rate, but this was to no avail.

The situation is similar in Taiwan, where births in 2022 fell below 140,000, an all-time low since statistics began to be kept. This was the seventh straight year for births to decline in Taiwan, and the third straight year, starting in 2020, for the population as a whole to shrink.

India Takes the Lead

Japan was also a leader in East Asia when it came to demographic trends of a falling birthrate and graying population. It was 1995 when the nation reached its peak population of productive age (15–64). The decline since then has largely overlapped the “lost decades” following the bursting of the Japanese economic bubble, and the nation saw its total population hit a peak in 2008, since when it has been gradually falling.

Economies like Korea, Taiwan, and China, though, have fertility rates even lower than Japan’s, and the speed at which they are experiencing these same trends is far higher. In China and Korea, meanwhile, real-estate bubbles are beginning to pop. Will they follow the Japanese lead in this area, too, experiencing lengthy economic downturns from here on out? (As a side note, preliminary GDP figures for the countries for 2022 show 1.0% growth in Japan, compared to 2.6% in Korea, 3.0% in China, and 2.4% in Taiwan.)

Looking farther afield to the ASEAN region, we see that while Thailand grew at a less than vigorous 2.6% in 2022, Indonesia was in the 5% range, the Philippines around 7%, and Vietnam and Malaysia around 8%. It is worth noting that fully 32 years have passed since the last time these five main Southeast Asian economies outperformed China.

India, meanwhile, which is positioned to overtake China in the global population rankings, has also considerably outstripped its massive rival in the economic department, achieving 6.7% growth in 2022. And the Indian population is projected to continue growing through the 2060s.

Looking West and South for Future Growth

Foreign direct investment in China in the second half of 2022 plummeted fully 73% year on year to reach an 18-year low. It appears that China’s “zero-COVID” measures have combined with its backtracking from the “reform and opening” course of recent decades, the risk associated with its economic standoff with the United States, and now concerns about the impact of the nation’s demographics on its economic outlook to degrade perceptions of its future growth.

We have entered an era of reduced inbound investment for China, combined with moves to transfer procurement of manufactured goods to other markets. This is boosting manufacturing bases outside of China, with the main beneficiaries of these trends being Vietnam, Malaysia, and other economies in Southeast Asia.

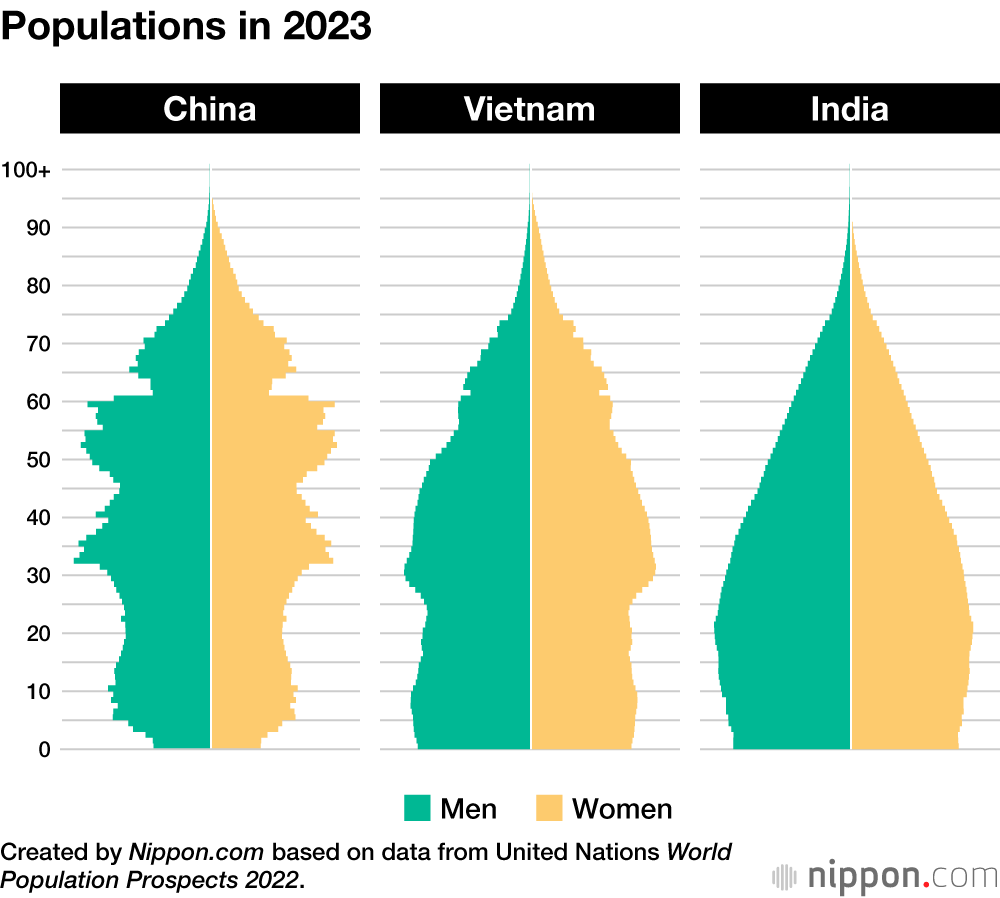

An additional reason for this is clear if we look at the population pyramids for these various economies. Southeast Asian countries tend to have bottom-heavy demographic shapes, with bulges in the younger working-age cohorts. China, along with its Northeast Asian neighbors, meanwhile, has a top-heavy population structure, with bulging cohorts higher in age. And India is finally starting to shift from a traditional wide-based pyramid to a demographic structure with a bulge moving upward through the age brackets.

All of the above paints a clear picture of the region’s economic future. The global center of growth seems likely to move inexorably from East Asia to Southeast Asia, and further still to India, in years to come.

(Originally written in Japanese. Banner photo: Children at an elementary school in Dongyang, China, take part in an athletic event on February 8, 2023. © Xinhua/Kyōdō Images.)