Hurdles Remain in Race to Bring Flexible Solar Panels to Japan’s Market

Environment Economy World- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Efficiency Gap

A team of scientists led by Professor Miyasaka Tsutomu of Tōin University of Yokohama has developed the basic technology behind perovskite solar cells, a flexible, lightweight alternative to the standard silicon cells sandwiched between heavy panes of glass. Japan is a major producer of the iodine these new cells use to generate electricity. Given that the country also has great technical expertise, the government wants to adopt an industrial policy of investing in the next-generation panels with research and development subsidies.

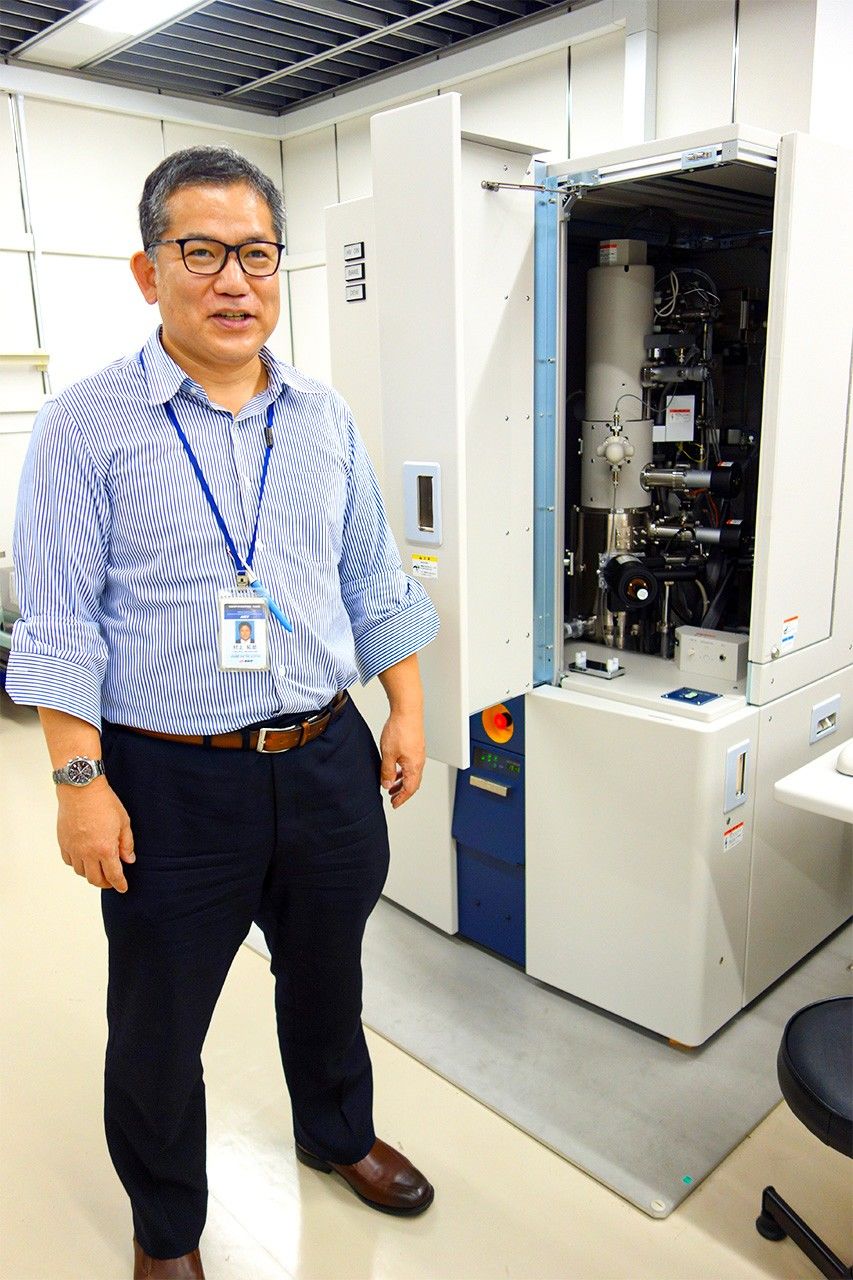

Murakami Takurō of the National Institute of Advanced Industrial Science and Technology. (© Mochida Jōji)

However, hurdles remain to full-scale commercial viability. One is the panels’ efficiency at converting solar energy into electricity. Murakami Takurō of the National Institute of Advanced Industrial Science and Technology (AIST) explains, “The smaller solar cells are, the more efficient they are at generation. Flexible solar panels have been reported as having an efficiency of 24%–25%, based on academic papers using tiny squares with sides of just a few millimeters long. But as you make them bigger to turn them into products, electrical resistance increases, and pinholes form within the material, leading to reduced generation of electricity.”

The actual efficiency of flexible solar panels is a maximum of 15% for 30-centimeter squares produced by Sekisui Chemical and a maximum of 16.6% for 703-square-centimeter panels from Toshiba. AIST states that current perovskite panels are less efficient at generating electricity than earlier silicon panels.

Keeping Dry

Flexible solar panels are also extremely vulnerable to moisture. If someone pinches or breathes on the electricity generation layer when it is not covered by protective film, it immediately changes color and becomes unusable.

The quality of the barrier film is a key issue. Murakami says, “This may be surprising, but in one day, up to several tens of grams of water pass through a square meter of the PET resin film that is used to make plastic bottles. For flexible solar panels, we need to reduce that to 1/100,000 of the total.”

A National Institute of Advanced Industrial Science and Technology laboratory (left), which is kept to 1% humidity by a large dehumidifier in another room (right). (© Mochida Jōji)

This special film is “the main cause of high costs, and companies are battling to find a way to make it cheaper,” according to Asatani Tsuyoshi, who heads a perovskite solar panel development group at Toshiba Energy Systems & Solutions. Moisture can also creep in through tiny gaps on the outside of the adhesive used to attach the film covers. Sekisui Chemical aims to use its proprietary sealing technology to prevent moisture from entering.

Solar panels operate in a harsh natural environment, and must withstand rain, wind, and direct sunlight. While silicon solar panels, covered by glass, have a lifespan of 25 years, flexible solar panels currently only last for 10 years. Sekisui Chemical has set a goal of extending this to 20 years, and aims to achieve this level of durability as soon as next year.

Silicon Disappointment

While the technology is still under development, Sekisui Chemical plans to launch a product in 2025 and Toshiba between fiscal 2025 and fiscal 2030.

The main reason for the haste is the race with rival companies overseas to take an early lead. The Chinese firm DaZheng Micro Nano Technology moved to build a major production line in 2023, while a University of Oxford start-up plans to begin mass production in 2025. While overseas companies may not manufacture items that compete directly with those of Japanese firms, the industry in Japan cannot afford to postpone launching until it has perfect products.

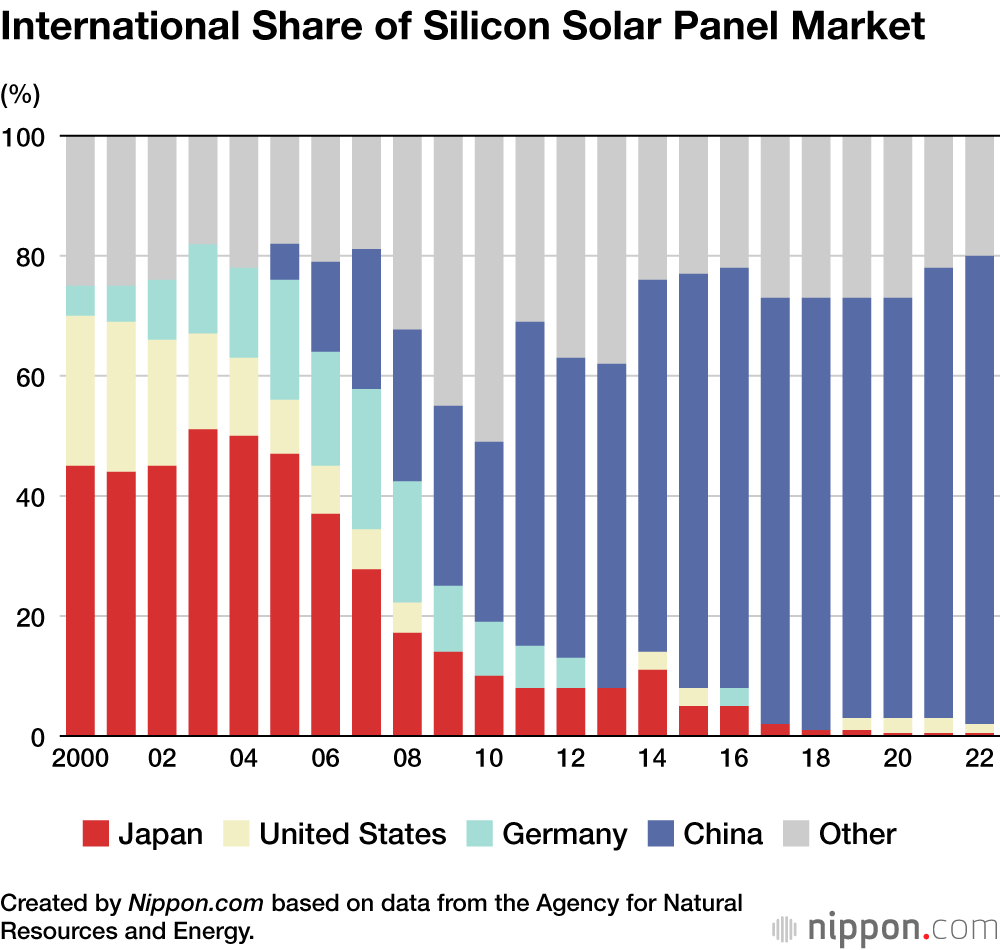

Even if companies get an early start, they will face fierce competition. Japan has the bitter experience of losing its initial advantage with silicon solar panels. From 2000 until 2007, Japan was the leading player in the international market, with a share of more than 50% at one point. However, since 2008, the market has been overwhelmed by cheap Chinese products, and even in Japan, almost all silicon panels in use are made in China.

Japanese companies have some first-rate technologies connected to the new solar cells, but Morita Takeharu, who heads a solar panel project at Sekisui Chemical, warns: “To stop the same thing happening as with silicon solar panels, the government needs to boost support targeting mass production—as it failed to do before—so that we can win out in both quality and cost.”

Solar Subsidies?

While the materials for flexible solar panels are cheap in themselves, other costs mount up, such as the expense of the barrier film and other related materials, along with the initial capital investment required for production. As development to boost durability and efficiency is still ongoing, it may be necessary to sell at a loss to compete with silicon solar panels.

Sakurai Yūsuke, who leads a strategic group at Toshiba Energy Systems & Solutions, says that companies are looking for new markets where the convenience of the new panels, which can be installed in places that would be impossible for silicon panels, are a key asset. For the moment, they are focusing on relatively niche markets where they can sell products at prices in keeping with their costs. The thinking is that they can reduce costs to some degree as demand expands and they move into mass production.

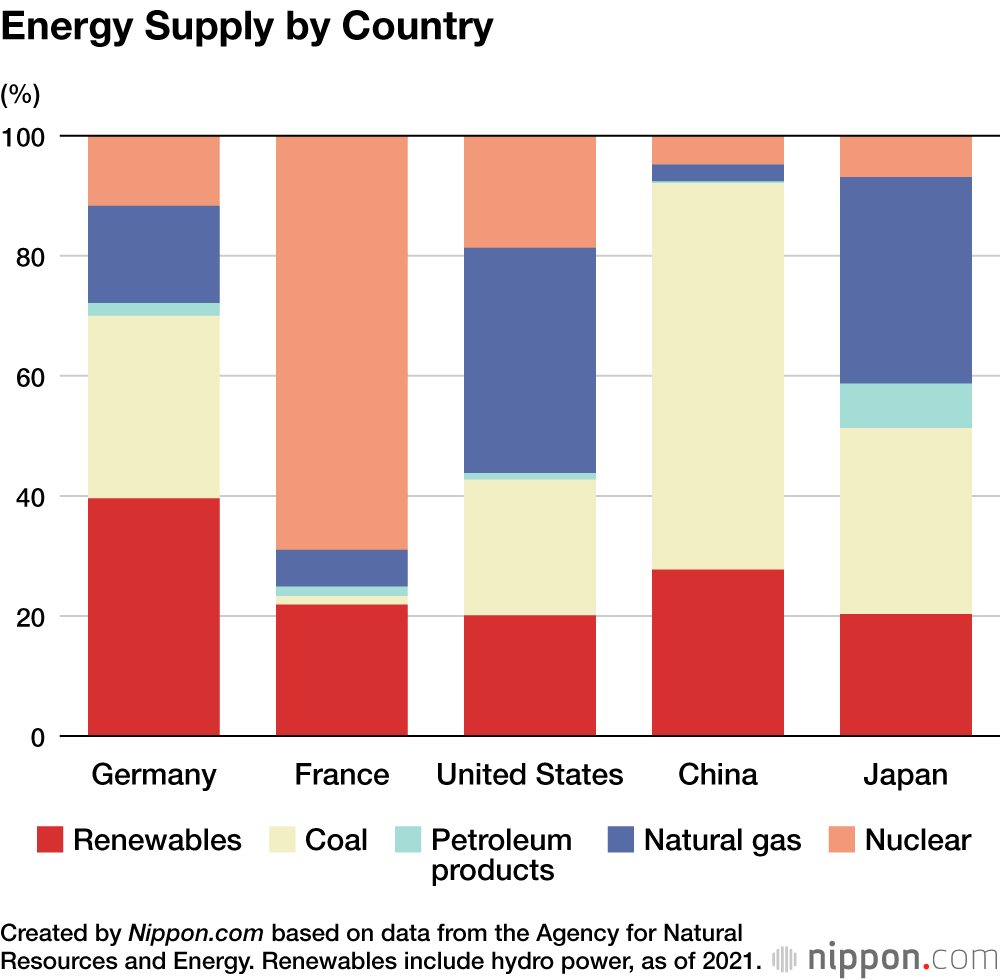

One source tells me, however, that the government is not satisfied with this strategy of targeting only niche markets. As part of its efforts to achieve carbon neutrality by 2050, its basic energy plan includes the goal of maximizing the adoption of renewables, and it emphasizes the importance of widespread use of next-generation solar cells. As almost all the required materials are domestically produced, including iodine, this is seen as beneficial from an energy security perspective.

The source is concerned: “Doing what the government says may mean investing in flexible solar panels even in fields that will be initially unprofitable. Simply aiming to follow this will mean going into the red.” The industry and local governments have appealed for government support, including subsidies, to increase customers.

According to a report from Jiji Press, the Ministry of Economy, Trade, and Industry plans to seek ¥255.5 billion in its FY2025 budget estimate to build a domestic supply network for perovskite solar cells and other innovative products contributing to decarbonization.

Battling for the International Market

In May, the Agency for Natural Resources and Energy launched a public-private council to promote the use of next-generation solar cells. A number of solar manufacturers line up among the participants, with the customer side represented by business groups like Keidanren (Japan Business Federation) and the Japan Chamber of Commerce and Industry, as well as JR companies and firms from the architecture, housing, and real estate industries. There are also over 100 local governments, notable as owners of numerous public facilities where the new solar panels can be installed.

Manufacturers will initially focus on domestic sales, but the main battleground in the future will be the international market. Fuji Keizai, a company specializing in economic research, estimates that while the Japanese market for flexible solar panels will be worth ¥23.3 billion in 2040, the international market will be more than 100 times greater, at ¥2.4 trillion.

AIST’s Murakami says, “It won’t be a case of just launching the next-generation solar panels and stopping there—we’ll have to keep developing the technology. And without steady expansion overseas, there won’t be any of the real benefits of mass production, and prices won’t drop enough. Right now, Japanese companies have a technological advantage internationally, but if we just sit back, then Chinese companies might take over the market, as they did with silicon panels.”

(Originally published in Japanese on August 29, 2024. Banner image: The Agency for Natural Resources and Energy at the Ministry of Economy, Trade, and Industry is working to popularize flexible solar panels. © Matsumoto Sōichi of Nippon.com.)