Japan Still Big Importer of US Beef, Despite TPP Competition

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

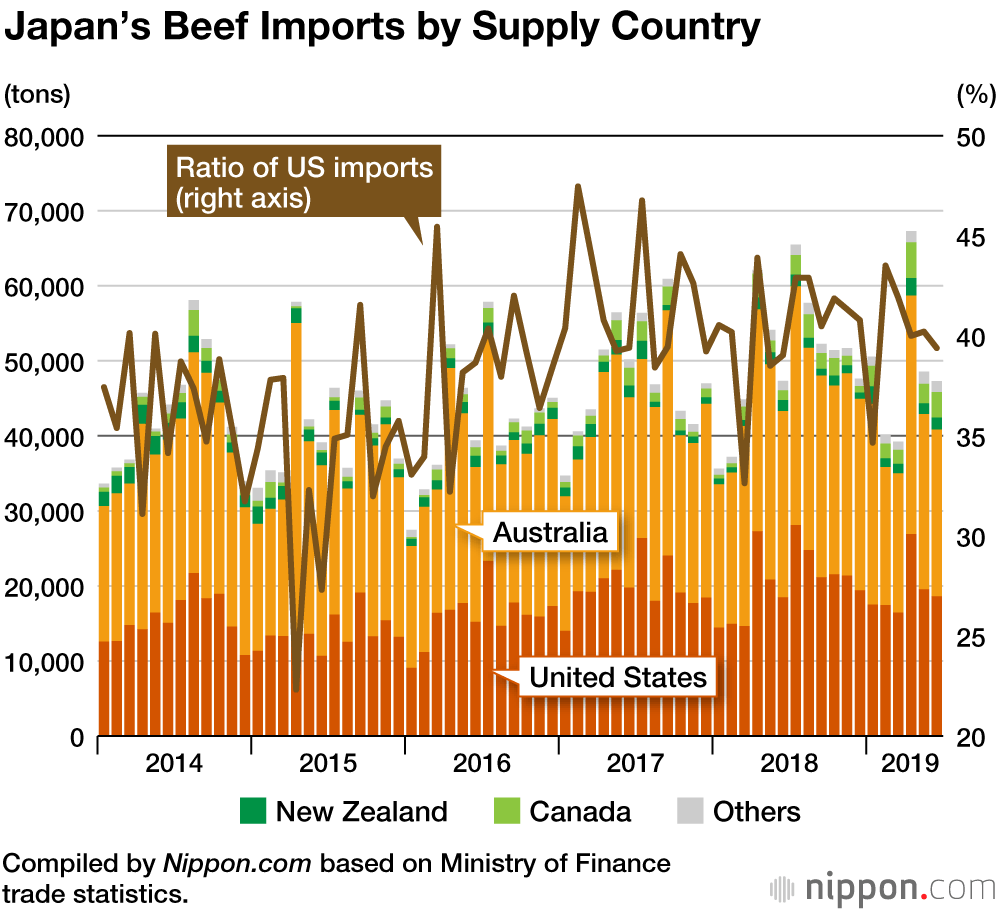

Reduced tariffs have spurred increases in beef imports to Japan from some other countries in the Trans-Pacific Partnership like New Zealand and Canada. When the TPP came into effect at the end of 2018, beef tariffs were reduced from 38.5% to 27.5%, and in April 2019 they fell further to 26.6%.

Ministry of Finance trade statistics show that the volume of beef imported from New Zealand rose 46.4% to 10,101 tons from January to June 2019, the period after TPP came into effect, and beef from Canada climbed 93.3% to 17,285 tons. These were both significant increases.

Beef Imports to Japan Before and After TPP

| January–June 2018 (tons) | January–June 2019 (tons) | Change from previous year | |

|---|---|---|---|

| United States | 110,621 | 116,478 | +5.3% |

| Australia | 148,975 | 141,075 | –5.3% |

| New Zealand | 6,901 | 10,101 | +46.4% |

| Canada | 8,943 | 17,285 | +93.3% |

| Others | 5,835 | 8,103 | +71.7% |

Compiled by Nippon.com based on Ministry of Finance trade statistics.

While imports from the United States, which withdrew from TPP, only increased by 5.3%, this is not catastrophic for American farmers by any means when viewed from the perspective of long-term statistics.

American and Australian beef have long accounted for some 90% of imports to Japan. While the TPP has opened up the market a little, imports of US beef continue to hold a 40% share in 2019 and the United States and Australia continue to dominate the market.

The United States is concerned though about the long-term effects of withdrawing from the TPP and has reached a basic bilateral trade agreement with Japan to receive equal tariff reductions.

An additional knock-on effect is that, if the reduction in tariffs brings about an increase in the distribution of reasonably priced imported meat, Japanese livestock farmers will need to work harder to be competitive.

(Translated from Japanese. Banner photo © Pixta.)