Unclear Road Ahead for Nissan After Talks Fall Through with Honda

Economy World Environment- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

On February 13, Honda Motor Co. and Nissan Motor Corp. announced the termination of their memorandum of understanding aimed at business integration via the establishment of a holding company. “We proposed a one-governance structure, but were unable to come to an agreement,” explained Honda CEO Mibe Toshihiro during an online press conference. By “one-governance structure” he referred to making Nissan a subsidiary of Honda, rather than integration through a holding company.

By the time of the December 2024 announcement that the two firms were engaged in talks toward a merger, it had been agreed that Honda would select the president and the majority of the board members of the holding company, and so it was clear that Honda would lead the business integration. However, Nissan would still be guaranteed some level of management independence, such as control over personnel matters. If Nissan became a fully owned subsidiary, on the other hand, it would grant Honda control over key decisions, including executive appointments and business strategies.

Nissan CEO Uchida Makoto held a press conference as well, stating, “We determined that it would be difficult to maximize our strengths under a subsidiary structure,” emphasizing Nissan’s prioritization of maintaining management independence. Another Nissan executive took issue with Honda’s approach, stating, “Right after we agreed to pursue business integration through a holding company, Honda changed the key prerequisites. This is a problematic way of negotiating.”

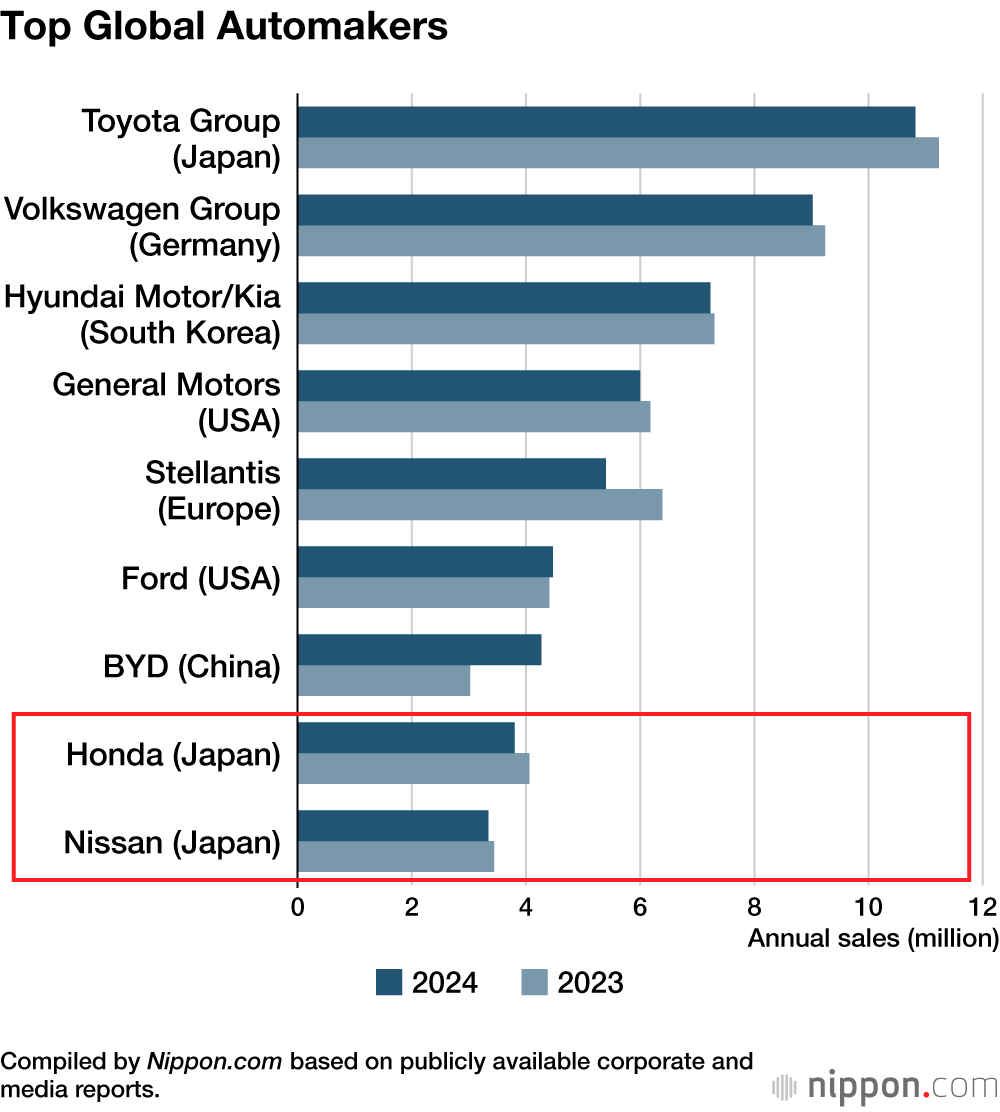

Why did this potential deal of the century—one that could have created the world’s third-largest automaker, trailing only Toyota and Volkswagen—fall apart just a month and a half after its announcement? Below I examine the behind-the-scenes negotiations and look at what may lie ahead.

An “Engagement Announcement” Turned Cold

When asked what he admired about Nissan last December at the press conference announcing the start of business integration negotiations, all Mibe could say was, “That’s a difficult question.” The business integration of the two companies might be compared to a marriage. Mibe’s answer amounts to not being able to explain the positive qualities of one’s future spouse.

This response came with some context. After announcing that they would cooperate in the EV sector, the two companies established six working groups and held talks on key topics. A potential capital partnership was also on the table when the collaboration was first announced.

In deepening their relation through negotiations, a major miscalculation was the extent of Nissan’s worsening financial situation. In its business forecast for the fiscal year ending March 2025, released on February 13, Nissan’s projected a net loss of ¥80 billion, a sharp drop from its net ¥426.6 billion net income in the previous year.

Even in the business collaboration negotiations which began last August, Honda’s management considered Nissan’s business restructuring as a key criterion for successful business integration. In its press release announcing the negotiations, Honda emphasized that achieving a Nissan turnaround through the steady implementation of its business revitalization plan would be a prerequisite. This refers to the plan Nissan announced on November 7, which entails cutting 9,000 jobs (7% of its workforce) and reducing production capacity by 20%.

Frustration Over Slow Decision Making

However, Honda saw Nissan’s restructuring efforts as progressing too slowly. Also, during the negotiation process, “there were multiple instances where decisions made through discussions between CEOs Mibe and Uchida were later overturned within Nissan,” according to a Honda insider. Therefore, Honda concluded that there was a problem in Nissan’s decision-making process that was resulting in slow management execution.

By the end of 2024, Honda had started considering making Nissan a subsidiary, and by mid-January, discussions had reportedly started on who Honda would appoint as Nissan’s new president if such a plan went forward. “Mibe and Uchida met on January 23 for a final confirmation on whether Nissan would accept subsidiarization,” a source said.

Uchida considered the idea of subsidiarization within the company, but during a February 4 meeting with top executives, Executive Vice President Sakamoto Hideyuki, who oversees production, fiercely opposed the plan. This ultimately led Nissan to end negotiations with Honda. One Nissan employee has said, “Sakamoto is older, more experienced, and has a stronger career track record than Uchida, so part of the company looks to him rather than the CEO.”

An emergency meeting of the board of directors was held on February 5, where only 2 out of 12 directors supported continuing the integration negotiations. Given this outcome, Uchida informed Mibe the following day that negotiations would be called off.

Tesla and Foxconn Named as Candidates

How will the two companies proceed from here? Honda’s Mibe has stated that the company has several plans in place. Meanwhile, at a press conference on February 13, Nissan declared its intent to “pursue opportunities for strategic partnerships that would significantly increase corporate value,” indicating a willingness to seek new potential alliances.

Among industry insiders, there are four different perspectives on the future trajectories of Nissan and Honda.

In Nagatachō, the heart of Japanese politics, there is speculation that Nissan could team up with a US company, possibly Tesla. It has been reported that during the February 8 Japan-US summit, President Donald Trump mistakenly referred to Nippon Steel as “Nissan” three times while discussing the US Steel acquisition issue. Tesla CEO Elon Musk is one of Trump’s close associates. Perhaps Nissan’s name is lingering in the president’s mind.

Another possibility is that leading Taiwanese electronics contract manufacturer Foxconn will make a full-fledged attempt to acquire Nissan. Since last autumn the company had been laying the groundwork by engaging in talks with Mizuho Bank, Nissan’s main bank, as well as Japan’s Ministry of Economy, Trade, and Industry, and it is believed these discussions are still ongoing.

Foxconn’s electric vehicle, the Model E. (© Walid Berrazeg/SOPA Images via ZUMA Press Wire/Kyōdō)

Joint Acquisition by Honda and Foxconn?

A third possibility, in my view, is that Honda and Nissan might resume integration negotiations. As touched on earlier, a business integration between the two has the potential to generate a synergy effect amounting to ¥1 trillion. Honda may be reluctant to walk away just yet. If the Uchida-led management, with its slow decision-making process, is replaced, renewed moves toward integration could be on the horizon.

Honda’s four-wheel vehicle business remains notably less profitable than its two-wheel business. Mibe explained internally that the decision to pursue business integration was made because, under current conditions, the automobile business cannot sustain itself independently.

Finally, a scenario where Foxconn and Honda pursue a joint acquisition is also possible. Some insiders note that Honda holds Seki Jun, Foxconn’s EV chief strategy officer and key negotiator in Japan, in high regard.

Seki was formerly vice-COO at Nissan, handling structural reform. He is therefore deeply familiar with Nissan’s internal operations. I believe it is possible that Foxconn and Honda may join hands, with Seki spearheading restructuring efforts while Honda, Nissan, Foxconn, and Mitsubishi Motors focus on growth strategy, forming a new Japan-Taiwan corporate alliance.

Times are moving rapidly. Major developments may emerge in the spring of 2025, and we may see news break from Japan that will capture the attention of the world.

(Originally published in Japanese. Banner photo: Nissan CEO Uchida Makoto, at left, and Honda CEO Mibe Toshihiro, at right, hold press conferences separately following the termination of negotiations for business integration. February 13, 2025. © Jiji.)