The Japanese Economy in 2025: Dark Skies Ahead?

Economy Politics Lifestyle- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Japanese Deposits Take an Inflationary Hit

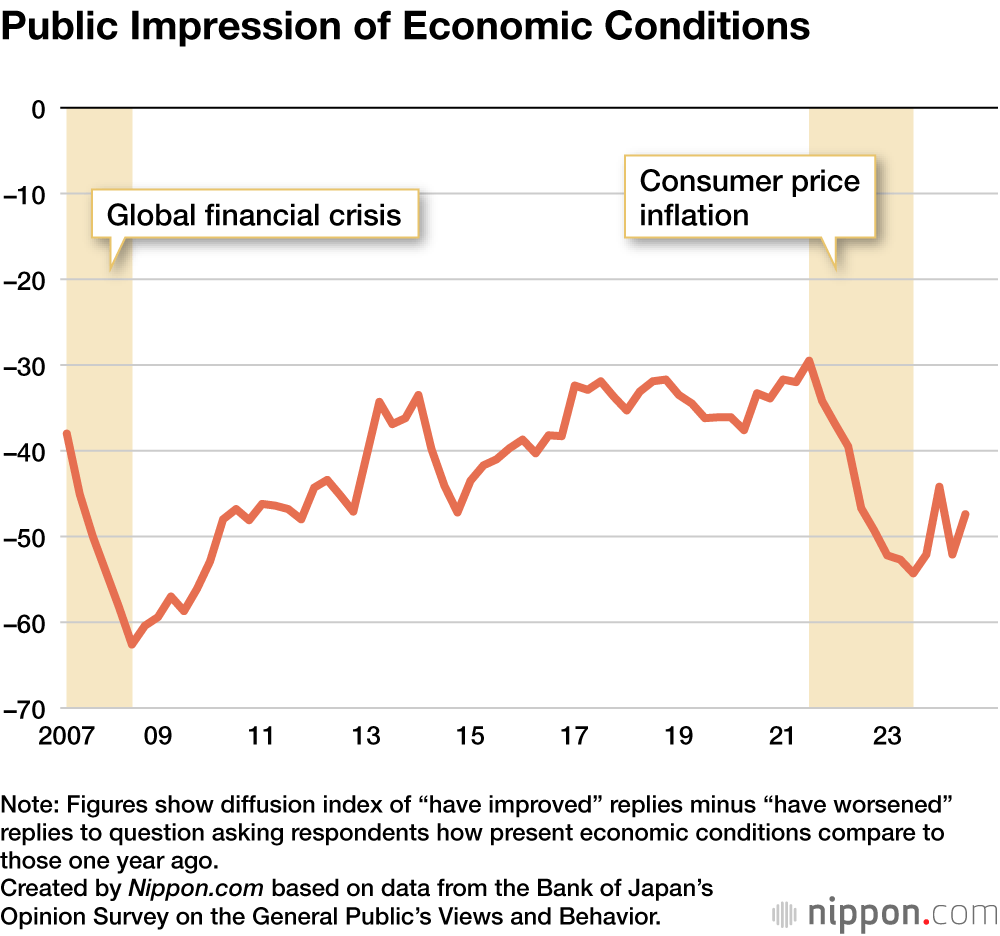

Just as the recent general election revealed broad public dissatisfaction with the economy, says the economist Momma Kazuo, a former executive director at the Bank of Japan, the central bank’s Opinion Survey on the General Public’s Views and Behavior indicates that the public has a poor view of household circumstances. “The diffusion index for the impression of present household circumstances—here meaning ‘better off’ replies minus ‘worse off’ replies—fell sharply between 2022 and 2023, when prices rose. The cumulative decline of this statistic nearly equals the decline recorded during the global financial crisis of 2008. From the perspective of households, the inflation that occurred in 2022 and 2023 is a blow comparable to that crisis.”

The financial crisis of 2007–8 was a huge shock for some people. Many temporary workers lost their jobs, and volunteers responded by providing year-end support in city parks. Currently, however, the public as a whole feels that rising prices have worsened household circumstances.

“Households in Japan hold some 1.1 quadrillion yen in cash and deposits,” notes Momma. “Such savings have lost about 90 trillion yen in value due to inflation of around 8 percent over a three year period. In addition to this loss of wealth, monthly wages are not keeping up with inflation. There is no need to wonder why households feel this as a blow comparable to the financial crisis. Consumption has yet to return to its level in 2019, before the COVID-19 pandemic. Sluggish consumption is likely to continue for some time.”

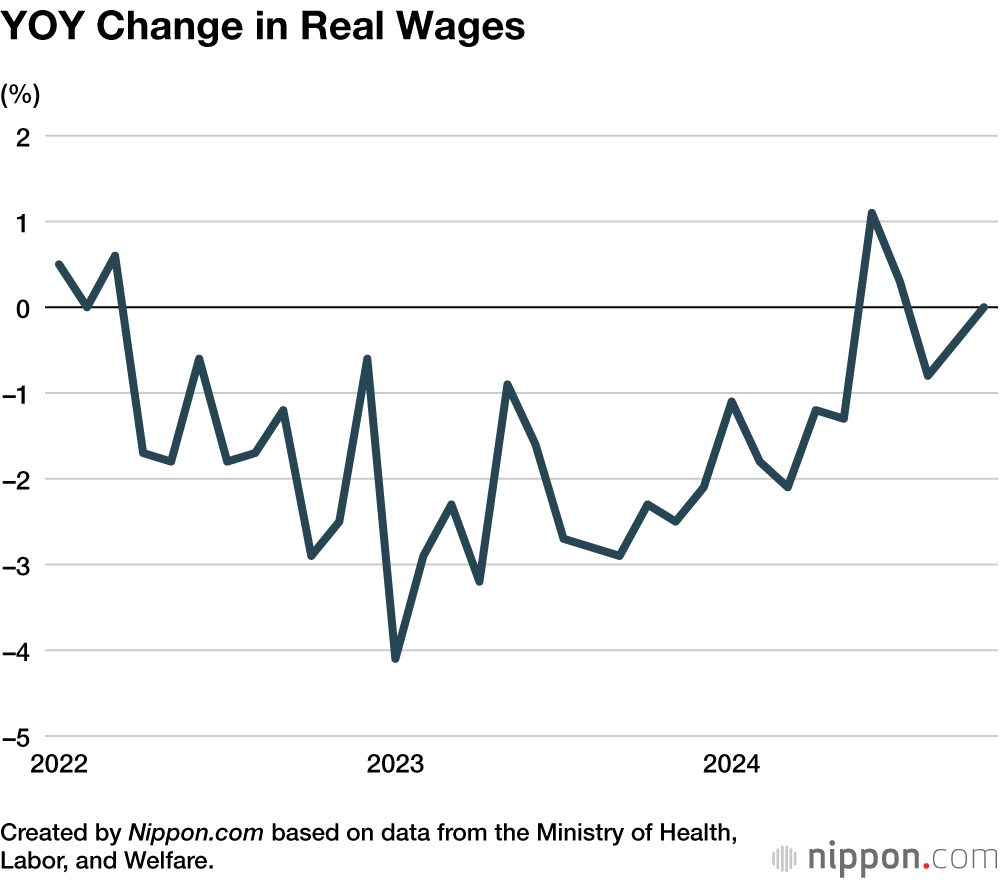

How does Momma view the situation for real wages, which factors in the increase of prices? “The year-on-year growth of real wages has wavered between positive and negative in 2024. There is the possibility that real wages will be slightly positive in nearly every month in 2025. Wages are expected to grow between 2.5 percent to 3 percent, as in 2024, while prices are foreseen to stabilize and rise by 2 percent, or somewhat less. This will be the result of the diminishing effect of past increases in import prices.”

That said, Momma adds, it will be important to monitor the direction of prices. “There are global supply constraints to consider, such as geopolitical risk, supply chain fragmentation arising from conflict between the United States and China, climate change, falling birthrates, and aging populations. These are constraints that will make inflation likely.” While inflation will not necessarily be high, he says, the consensus view is that we will not be returning to a period of low inflation as in the 2010s. Whether the increase of wages will be adequate in relation to the trend for prices is uncertain in the case of Japan.

Negligible Effect of Increasing the “¥1.03 Million Wall”

The Democratic Party for the People has proposed raising the current tax-exempt income threshold from ¥1.03 million to boost net income. “This proposal deserves to be accepted from the perspective of social equity,” says Momma. “This is because the basic deduction, which is intended to guarantee a minimum level of income needed to maintain daily life, has been left unchanged for far too long.”

However, in terms of economic policy, raising the so-called ¥1.03 million wall will not have much of an effect. The ruling coalition of the Liberal Democratic Party and Kōmeitō, along with the Democratic Party for the People, have agreed to work toward increasing the income tax exemption to the ¥1.78 million level, a move expected to reduce the nation’s income tax revenues by some ¥7 trillion to ¥8 trillion annually. As Momma says, though, “Even if we assume this all ends up in the pockets of taxpayers, it’s still a far cry from the 90 trillion yen in value erased from their savings in recent years due to inflation. What’s more, projections are that only around a quarter of tax reductions will find their way back into the economy via consumption, which means this measure represents a maximum boost of just 2 trillion yen or so to the economy, or just around 0.4 percent of GDP.”

To address the issue of labor shortages, increasing the “wall” thresholds for tax exempt in areas including part-time work taxation, pension contributions, and social insurance premiums is also being considered. While such changes may have some effect, whether they will actually be felt is doubtful. “For example,” explains Momma, “the phenomenon of college students limiting their part-time work hours toward the end of the calendar year so their parents can claim a dependent tax deduction might be alleviated, enabling them to work to the end of December. It’s hard to say whether we could expect such an effect to be large or small, in terms of the economy as a whole.”

Japan’s economy lacks a driving force, and the nation must work hard to keep the economy afloat. One positive example of increasing growth capacity is the entry into Japan of the Taiwan Semiconductor Manufacturing Company, a Taiwanese multinational contract semiconductor manufacturer. “The semiconductor industry is one of Japan’s strengths,” notes Momma, “and the incorporation of outstanding foreign capital will form a foundation for advancing it still more. The government has invested more than 1 trillion yen in this project. Since this is the last chance for Japan, not providing support is the greater risk. This must be done now so as not to lose an industry that has been Japan’s forte. Now that funds have been committed, Japan must maintain firm resolve toward achieving success.”

Japan has few other industrial sectors that can rival the promise of semiconductors. “Since the nation faces many issues, it’s going to need to strengthen areas like renewable energy and information technology with conviction to respond to the challenges of its declining birthrate and aging population. To achieve these ends, Japan should accept necessary technology and human resources from abroad. What the country needs is a growth strategy based on this sort of vision.”

The Threat of Trump Tariffs

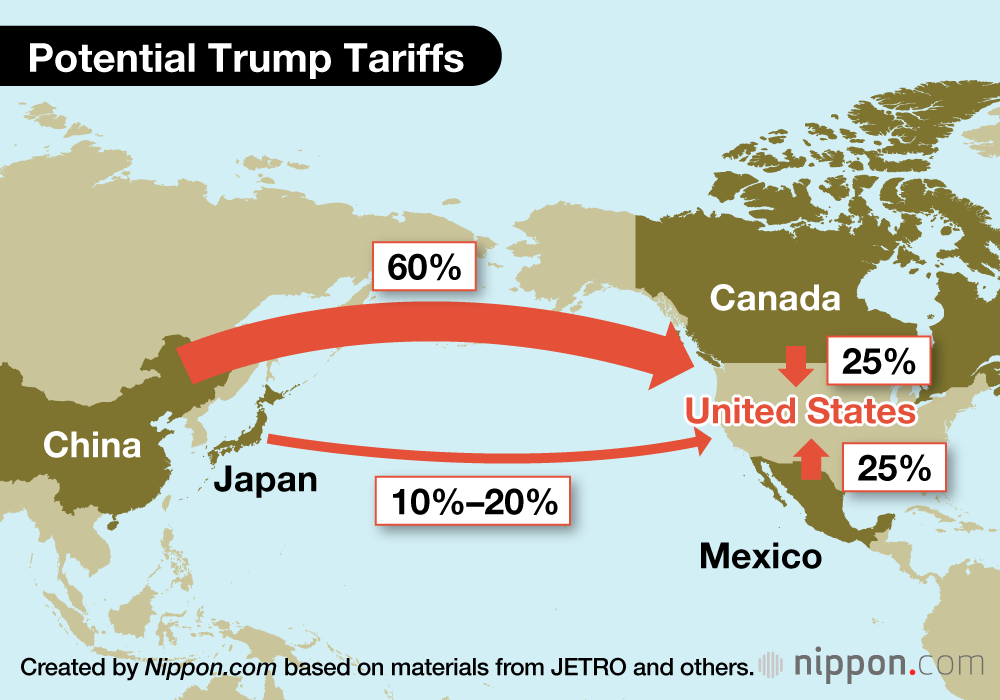

Donald Trump will return to the White House in 2025. Should he impose 10% to 20% tariffs on all nations as promised, this would trigger a global trade war, since counterparts are likely to respond with retaliatory tariffs. The International Monetary Fund has warned that the adverse impact on the world economy would be considerable. Naturally, Japan’s economy would take a blow as well.

Trump is also intending to impose 25% tariffs on Mexico and Canada, nations that are Japan’s production bases for auto parts and vehicles marketed in the United States. Should such tariffs be imposed, their impact would be enormous. This is a worrisome prospect since automobiles are a core Japanese industry.

“Unrelated to Trump, China is in dire straits from the collapse of a real estate bubble, and Japan’s exports to China have already decreased,” adds Momma. “As its economy worsens, China has boosted exports of its excess production. In such markets as Southeast Asia, the Middle East, and Africa, Japanese companies are under pressure from Chinese products. While this is not the only cause, the earnings of Japanese manufacturers are not growing by much. Should the Trump administration impose a 60 percent tariff on China as promised, Chinese products losing the US market are likely to flow even more vigorously into other markets.”

What explains the support given to Trump’s America First policy? As Momma explains: “The United States viewed economic globalization favorably until the beginning of the 2000s. The inclusion of China in global markets enabled an expanding economic equilibrium. US companies were able to engage in low-cost mass production globally, and everybody profited.

“Starting in the 2010s, though, the United States became increasingly aware that globalization did not benefit the nation. The US economy was slow to recover from the crisis of 2008, income disparities widened, white-collar workers lost their jobs, and the middle class declined. The idea that these changes were the consequence of globalization gained currency.”

The view that a system that does not benefit the United States and only benefits China and emerging economies is wrong is held not just by Trump but widely in the United States, according to Momma. Protectionism and an America First attitude are gaining momentum in reaction to globalization. The United States was once unquestionably the strongest economy, but when a rival like China appears, conflict over the position of leadership arises.

Falling US Interest Rates and a Strengthening Yen

“US interest rates are expected to decrease under the Trump administration,” Momma continues. “Protectionism will cause prices to rise, and consumers will lose purchasing power. Policies to reduce government expenditures and to restrict the inflow of immigrants will work to undermine the economy. These prospects suggest that the Federal Reserve will reduce the policy interest rate going forward.”

With the decrease of US interest rates, the yen is likely to appreciate to 140 to 150 to the dollar. While the extent to which Trump is considering foreign exchange policy is unknown, the weakening of the dollar will be a positive for US industry.

In conclusion, Momma has this to say: “The outlook for Japan’s economy in 2025 will continue to be cloudy. Uncertainties abound, though. The sun could briefly shine. Or Trump could lose his senses and raise tariffs to 10 percent to 20 percent, which could cause a downpour for Japan’s economy. While Trump may not go so far in imposing tariffs, as long as there are clouds, there is a chance of rain.”

(Originally published in Japanese based on an interview by Mochida Jōji of Nippon.com. Banner photo: People on their way to work in the Marunouchi district of Tokyo. © Pixta.)