Does the New Freelance Act Protect Freelancers? New Working Styles Challenge the Notion of the “Employee”

Politics Society Work- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The Rise of the Noncompany Worker

In recent years, the Japanese government has moved to officially define the category of “freelancer” in response to an increase in people working outside the typical employer-employee relationship. In 2021, the Japan Fair Trade Commission, which acts as an enforcement agency for the Antimonopoly Act, was the first to define a “freelancer.” According to its 2021 guidelines freelancers are “any self-employed persons or sole traders (sole business owners) who have neither fixed physical business premises nor any employees and who earn income utilizing their own experience, knowledge, and skills.”

The JFTC’s definition was subsequently adopted by the Ministry of Internal Affairs and Communications for its 2022 Employment Status Survey. The survey subsequently found that 2.09 million people in Japan met this definition of a freelancer for their main occupation, accounting for 3.1% of the total worker pool. A further 480,000 worked as freelancers in side jobs. In 2023, the JFTC’s definition became entrenched in law with the passage of the Act on Ensuring Proper Transactions Involving Specified Entrusted Business Operators (the “New Freelance Act”), due to take effect on November 1, 2024.

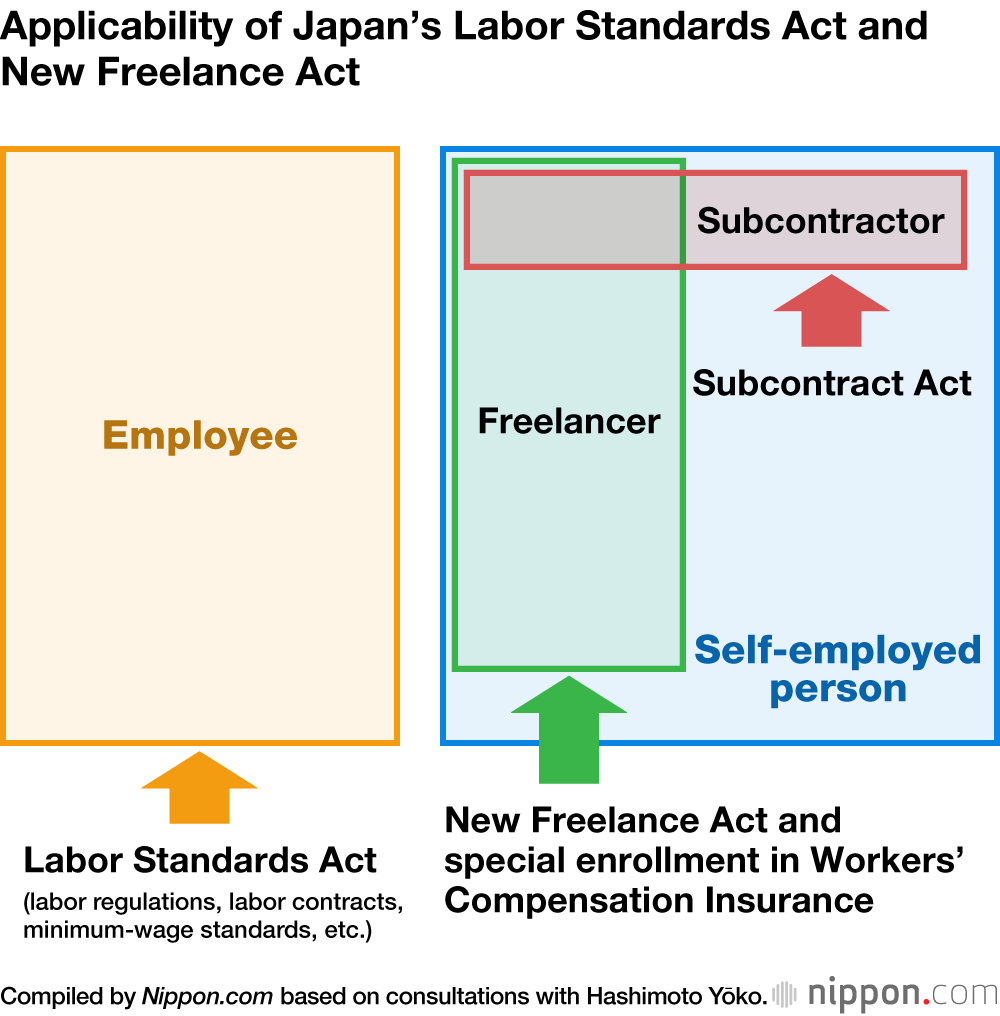

Alongside the rise in the number of freelance workers in Japan is an increasing need to provide protections for these workers. The New Freelance Act adopts similar standards as the Subcontract Act and applies them to freelancers to protect their conditions of employment. In essence, they acquire the status of “self-employed” subcontractors.

In addition to the obligation for clients to provide a written document that clearly defines the terms and conditions of a contract, for contracts of longer than a month, the NFA prohibits various acts detrimental to the freelancers. This includes unreasonable payment delays and the practice of kaitataki—defined in law as “setting subcontract proceeds at a level conspicuously lower than the price ordinarily paid for the same or similar content of work.”

The NFA was necessary as the Subcontract Act only provided its protections to subcontractors if their client possessed capital exceeding ¥10 million yen. However, around 40% of the clients with whom freelancers work possessed capital of ¥10 million yen or less. The new law thus had the effect of extending protections to greater numbers of freelancers working in ways similar to company employees.

The law also stipulates the establishment of a system to prevent harassment and provide counseling. For freelancers continuously employed by the same client for a period specified by cabinet ordinance (currently set at 12 months), clients are obligated to assist freelancers to balance work with childcare and nursing care for family members and give at least 30 days’ notice in the case of midcourse termination. The NFA is supervised by the JFTC for those provisions related to business terms and conditions, and the Labor Bureau of the Ministry of Health, Labor, and Welfare for provisions related to labor conditions.

Basic Provisions of the New Freelance Act

The client is obligated to deliver a written document setting forth the terms of the contract, including:

- Prohibition of late payments and the practice of setting subcontract proceeds at a level conspicuously lower than the price ordinarily paid for the same or similar content of work (kaitataki)

- Establishment of a harassment consultation system

- Obligation to give consideration during childcare and nursing care

- Obligation to give 30 days or more notice of termination

The NFA builds substantially on the Subcontract Act, which was first enacted in 1956. The Subcontract Act regulates the terms and conditions of transactions between subcontractors and counterparties. As a special law sitting under the 1947 Antimonopoly Act, it has a social policy function and is designed to regulate the abuse of superior bargaining positions by powerful employers and companies.

In Europe and the United States, the main concern regarding the abuse of superior bargaining position is focused on how dominant market position is used. In Japan’s case, however, the focus is on inequality in a particular business relationship. Thus, the Subcontract Act and the New Freelance Law together offer better protection for freelance workers than before, using a distinctive Japanese approach to legislation.

Are Freelancers Self-Employed or Employees?

The new law enhances protections for freelancers from unilateral and arbitrary requests made by clients.

In one case, a client pressured a freelance writer to take a 50% reduction in compensation, saying that ChatGPT would be used to reduce the workload. When the freelancer consulted the JFTC about this request, the JFTC explained that the client could be found guilty of the practice of kaitataki “if the price is determined solely based on the client’s circumstances, without sufficient consultation with the subcontractor or freelancer.” Considering that until now there were no laws or regulations to deal with such circumstances, the NFA carries some significance.

One problem that was not considered in the process of enacting the NFA was whether freelancers are truly self-employed in the first place. The official definition of a freelancer is rather broad and could include people who are not self-employed but are really employees whose work should be regulated under the Labor Standards Act.

The question of whether a person who is working as a freelancer or is in fact an employee in Japan is based on whether a person can be judged as possessing “employee status.” I will now look briefly at this issue.

The “Employee Status” Concept

In order for the specific protections of the Labor Standards Act to apply, a working person must be judged to possess “employee status,” rather than being a freelancer.

Although there are small differences place to place, most countries judge a person to be an employee when there is “subordinate binding”—a clear, contractual relationship of subordination that binds a worker to a company and requires him or her to engage in work based on orders and directions from a superior in return for a wage.

Historically, this kind of relationship grew out of the relationship between master and servant. Over time, factory workers became the typical case of employees requiring protection due to the rapid onset of the Industrial Revolution. Both servants and factory workers provided their labor to an employer at a set time and place based on the directions of a superior. Employees cannot in most cases refuse to do the work that they are ordered to do.

These two cases were the prototypes for the modern employee/employer relationship. The key distinguishing features of this relationship that can be used to differentiate whether a worker is an employee or a freelancer could therefore be: (1) whether the worker has the freedom to accept or refuse work, (2) whether the worker is bound by time and place, (3) whether the worker is subject to direction and supervision over the content and method of work performance, and (4) whether the worker is substitutable.

The Gig Economy and Employee Status

The status of workers who take on one-off jobs through apps has become a major issue in Europe and the United States over the last decade. Such workers are often called “gig workers,” a term that derives from the English word for a one-off gathering of musicians for a performance.

The archetypal “gig workers” are drivers who use private vehicles for ridesharing purposes (in services like that provided by Uber) or to deliver food and other items. Gig workers are also called “platform workers” because they receive job offers through digital platforms that connect workers and clients with no prior relationship.

Since gig workers were treated as self-employed rather than employees covered by traditional labor protections, the status of gig workers has increasingly become a major issue in the West.

For example, from around 2020 the countries of the European Union one by one began to recognize rideshare drivers and food and delivery workers as employees through decisions made in their highest courts.

Then, in March 2024, based on the adoption of the Platform Work Directive, the “employee status” of gig workers was recognized by the European Union. The directive obliges each EU nation to establish legislative provisions to ensure that gig workers can enjoy the benefits of “employee status” and that preexisting regulations contained within the labor laws of each country are also applied to gig workers.

Debate Shelved in Japan

While Uber Eats delivery people were already a familiar sight in Japan, the ban on ride-sharing services was lifted on a limited basis in April 2024. The policy is being introduced cautiously, however. For example, drivers are still to be employed by existing cab companies. Japan can expect to see an increase in gig workers in the future, though.

Japan has taken a different path from the European Union, however. It has enshrined protections for gig workers through legislation that applies established business operations and labor laws to freelancers.

Nevertheless, the Yomiuri Shimbun did report in November 2023 that the MHLW’s Labor Bureau affirmed the “employee status” of drivers who had entered into a subcontracting agreement with a transportation company that was also a subcontractor. This made them eligible for the accident compensation insurance system that protects employees against the negative effects of injuries and illnesses suffered during work and commuting. As a result of this decision, Amazon in Japan is moving away from reliance on subcontractors that hire drivers as secondary subcontractors, and is instead hiring drivers on a primary subcontract basis.

This example of the reconsideration of the application of “employee status” is a welcome development. However, the NFA, by moving to protect freelancers through the extension of the coverage of the Subcontract Act, does not fully address the challenges relating to whether freelancers and gig might deserve “employee status.”

One example of why this might matter relates to the aforementioned issue of employee compensation insurance. As the NFA was enacted, freelancers were permitted to enroll in a “special enrollment” program allowing them to pay their own insurance premiums to benefit from insurance coverage. However, if freelancers were instead able to claim to be “employees,” the insurance premiums would actually be paid by their employers.

In enacting the NFA, consideration should originally have been given to protecting freelancers by broadly interpreting their “employee status” rather than expanding of the provisions of the Subcontract Act. However, since questions surrounding labor status are difficult and potentially controversial, the broader debate was shelved. Instead, the government decided that existing regulations and the provisions of the Subcontract Act would be applied to freelancers for the time being, rather than addressing the challenges posed by new working styles and employment trends head on.

(Originally published in Japanese. Banner photo: An Uber Eats delivery worker rides a bicycle through heavy rain in Tokyo. © Jiji.)