Looking to Emerging Technologies to Power Japan’s Green Transition: METI Official on the Costs and Opportunities of Renewable Energy

Economy Science- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

INTERVIEWER The government’s Sixth Strategic Energy plan, adopted in 2021, set a target of boosting the share of renewables, including hydropower, in Japan’s energy mix to between 36 and 38 percent by 2030. As of 2022, renewables’ contribution stood at 21.7 percent. With a new energy plan in the works, how would you assess Japan’s prospects for meeting the current target?

INOUE HIROO Prior to the 2011 accident at Fukushima Daiichi Nuclear Power Plant, renewables accounted for about 10 percent of Japan’s electricity production. Thanks to the feed-in tariff [FIT] system introduced in 2012, that figure doubled to more than 20 percent over the next decade. So, it seems to me that the deployment of renewable energy has been proceeding quite rapidly. Solar power has been growing especially quickly, rising from 0.4 percent in fiscal 2011 to 9.2 percent in 2022. Japan currently ranks sixth in the world in cumulative deployment of renewable energy and number three in installed solar power capacity. In terms of solar capacity per square kilometer of flat land, we’re number one, surpassing even Germany.

Renewables’ Share in Japan’s Energy Mix (percentage of electric power generated)

| FY 2011 | FY 2022 | FY 2030 target | |

|---|---|---|---|

| All renewables | 10.40% | 21.70% | 36%–38% |

| Solar | 0.40% | 9.20% | 14%–16% |

| Wind | 0.40% | 0.90% | 5.00% |

| Hydro | 7.80% | 7.60% | 11.00% |

| Geothermal | 0.20% | 0.30% | 1.00% |

| Biomass | 1.50% | 3.70% | 5.00% |

Source: Agency for Natural Resources and Energy

Now, as to whether we can achieve another doubling of renewables’ share by 2030, I think that’s going to be difficult, to be perfectly honest. Because we’re dealing with some very tough challenges.

One of these is working in harmony with local communities. In the area of solar power, for example, we already lead the world in the use of flat land for power generation. Now developers have begun using mountainsides and clearing forests for that purpose. And this has a lot of communities up in arms about potential safety issues, the impact on the landscape, and so forth. That’s why the 2023 revision of the Renewable Energy Act imposes stronger requirements on developers in terms of working with local residents.

Another big challenge is reducing the cost of electricity generated by renewables. Under the current system, electricity users pay a FIT surcharge [to support the purchase of electricity from renewables at the government’s guaranteed rate]. But given the high price of electricity in Japan, there are lots of complaints about the surcharge. The third challenge is rebuilding the power grid so that it can make efficient use of energy from renewable sources. We need to get moving on this, and we also have to redesign the distribution system so as to spread the costs fairly. The fourth task is boosting our grid-balancing capability—in other words, our ability to adjust supply to demand and minimize waste. This will entail more widespread deployment of energy storage systems, including storage batteries and pumped storage hydropower.

To these, I would add another fundamental challenge, that of accelerating development of homegrown technology. At present, practically all the photovoltaic panels used for solar power generation in Japan are manufactured overseas. Some people argue that foreign PV panel manufacturers have become the biggest beneficiaries of the FIT surcharge. So, people have begun arguing—quite understandably—that it’s time to change the game by supporting technological innovation in Japan’s own energy sector. One very promising investment target is perovskite solar cells. Floating offshore wind is another, although that might take a little more time. I think these two homegrown technologies could be keys to a winning strategy for Japan.

Big Breaks for Stationary Energy Storage

INTERVIEWER You mentioned battery energy storage as a key to grid balancing. Any new trends to report in that department?

INOUE New developments are taking place all around the world. The Japanese government is offering generous subsidies for adoption of battery storage systems, and we’re also helping to make such systems more profitable for operators.

Specifically, we’re setting the stage for the purchase of renewable energy and energy from storage batteries on Japan’s wholesale-electricity market and supply-demand adjustment market. Energy storage companies earn higher profits by charging their batteries during the day, when market prices for electricity go down [thanks to the abundance of solar power] and discharging them at night, when the market rates go up. We’re creating an environment for profitable energy storage, and that’s attracting investors.

We’ve also included energy storage contracts in our Long-term Decarbonization Power Source Auction, held for the first time this year. The winning bidders receive generous assistance from the government—not just support for initial capital investment but also subsidization of fixed costs necessary for equipment maintenance over a period of twenty years.

Additionally, we’re using proceeds from the government’s GX Economy Transition Bonds to finance capital investment by storage battery manufacturers. Japanese manufacturers are also showing strengths in the area of grid energy storage. For example, there’s Sumitomo Electric’s redox flow battery and JGK’s NAS battery, both of which have a longer service life than lithium-ion batteries. They’re not suited for use in electric vehicles, but they show great promise for grid energy storage, and with some more products like these, the sector could become part of a winning game plan.

Inoue Hiroo, head of energy conservation and renewable energy at the Ministry of Economy, Trade, and Industry. (© Nippon.com)

Solar Energy Game Changer

INTERVIEWER Perovskite solar cells are a hot topic in the field of renewable energy. Can you give us an idea of Japan’s progress in this area?

INOUE Perovskite solar cells were originally invented by Professor Miyasaka Tsutomu of Tōin University of Yokohama. Conventional solar panels are made from silicon, which is mostly produced in China. Perovskite cells are made primarily from iodine, of which Japan is the world’s second largest producer. There’s a glass type and a film type, and Japan, I believe, is leading the way in commercial development of the film type. It’s extremely thin and light, making it suitable for installation in places where conventional solar panels aren’t practical. So, it’s ideal for a small country with limited flat land, like Japan.

Companies like Sekisui Chemical and EneCoat Technologies have been developing and piloting the technology for commercial purposes with support from the government and the Green Innovation Fund. As part of a redevelopment project in Tokyo’s Uchisaiwaichō, there are plans to install perovskite cells over one whole wall of a high-rise building, scheduled to be completed in 2028. That building alone will have a generating capacity of 1 megawatt, the size of a community solar farm. In this way, perovskite solar cells have the potential to solve the issues hindering further expansion of solar power in Japan. The government is marshaling its entire arsenal of policy tools to hasten commercial mass-production and widespread deployment of the technology.

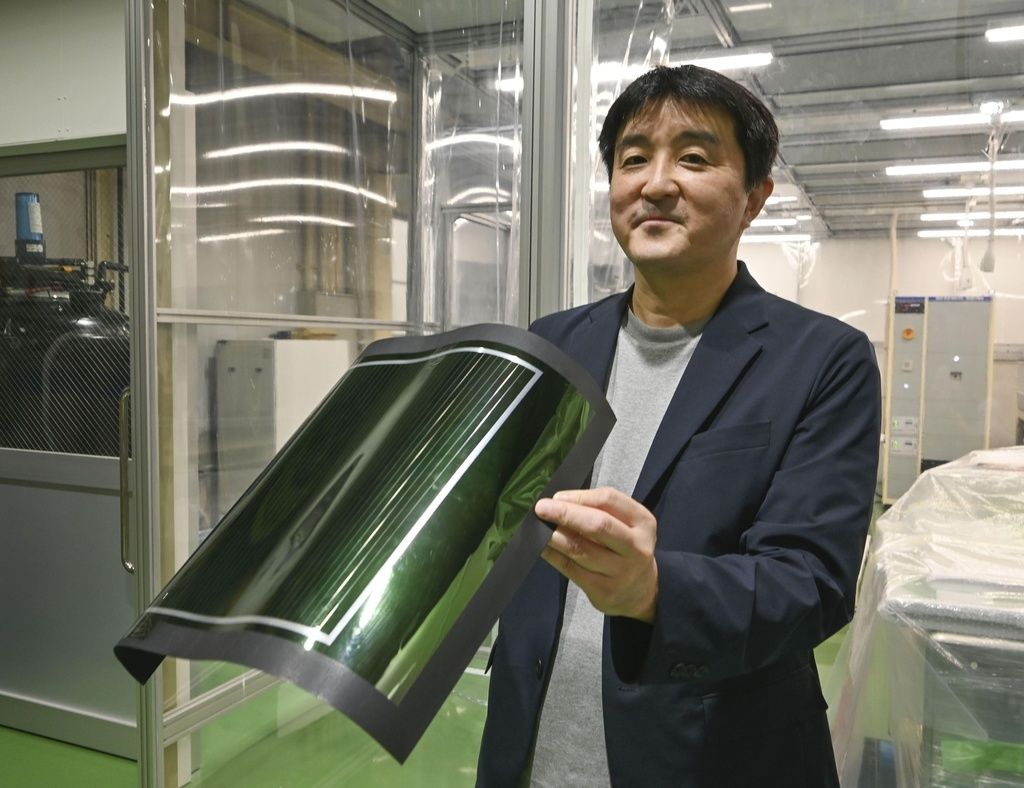

Katō Hisaya, president and CEO of Enecoat Technologies, with a perovskite solar cell. (© Kyōdō)

Creating a Floating Wind World

INTERVIEWER How about floating offshore wind? You mentioned it a moment ago as a technology that shows promise, even though it might take time.

INOUE Floating offshore wind is an energy source of huge importance to Japan. Our exclusive economic zone is the sixth largest in the world by area, but in most of that area, the ocean floor is too deep for installation of conventional offshore wind turbines. If floating wind power systems could be commercialized on a large scale, it would greatly expand the possibilities for deployment of wind power in Japan. So, the need is definitely there. Floating wind is also a technology that plays to Japan’s strengths in shipbuilding and floating structures.

It’s a lot more complicated than just mounting an ordinary wind turbine on a floating platform. The platform rolls and pitches in the water, which necessitates basic changes in the design of the turbine. Japanese manufacturers have pulled out of the market for large wind turbines, but they still have top-flight engineers, plus a lot of experience and data that they can draw on. I think they have what it takes to marshal Japan’s strengths and integrate wind turbines and floating structures into commercially viable wind power systems. It’s going to take time to bring the costs down, though.

The United States has high hopes for Japan in this field. During the bilateral summit in Washington last April, our two governments agreed to collaborate to accelerate development relating to floating wind farms. Europe is of the same mind, and we’re eager to embark on a three-way partnership. Of course, each participant will want to guard its competitive advantages in certain areas while collaborating in others, but I think as the partnership moves forward, the merits for Japan will become clear.

Leading the Way Toward the Hydrogen Economy

INTERVIEWER Lastly, I’d like to ask about METI’s policies for promoting the use of hydrogen fuel and fuel cells as a key to a carbon-neutral economy.

INOUE This past May, the National Diet enacted the Hydrogen Society Promotion Act. We’re still at a stage where the high cost of producing hydrogen fuel is deterring the kind of investment that could bring costs down. The law is designed to overcome this hurdle by allocating 3 trillion yen in GX [green transition] funding over 15 years to help close the cost gap between hydrogen and fossil fuels. Hydrogen has received a lot of attention worldwide as a low-carbon energy source with great potential for growth in the GX era, and it’s time Japan got serious about developing and deploying it.

Early growth of the hydrogen market is expected to center on Europe, and we think it’s important for Japanese industry to capture a share of that market. There are plenty of Japanese companies equipped to compete globally in such areas as the manufacture of water electrolysis equipment and electrolytic membranes, shipping of hydrogen fuel, and development of hydrogen-burning cars and generators. By supporting such investment, the Hydrogen Society Promotion Act will be contributing to Japan’s long-term economic growth while hastening the achievement of a carbon-neutral economy.

(Originally published in Japanese based on an interview on July 9, 2024. Interview and text by Ishii Masato of Nippon.com. Banner photo: Wind turbines and solar panels generate electric power at Rokkasho, Aomori Prefecture. © Jiji.)