Japan’s public finances had already taken a turn for the worse before the March 11 earthquake, but the situation is likely to become even direr as a result of the disaster. Nariai Osamu, a professor and former government official, considers whether Japan can sort out its fiscal mess while paying for its recovery.

In the wake of the earthquake and tsunami of March 11, Western credit rating agencies one after another made downward revisions in their assessments of Japanese government bonds. The reasons are not hard to understand. Japan’s ability to sustain its social security system had come into question even before the catastrophe, and the outlook for public finances was further darkened by various spending schemes introduced by the Democratic Party of Japan after it took power in September 2009. Moreover, the anticipated upturn in revenues had been slow to appear.

On top of this, the natural disaster made an expansion in government expenditures on recovery and reconstruction inevitable. When one also takes into account the burden on the government stemming from the damage and losses caused by the nuclear power plant accident, one can see that public finances are likely to be in desperate straits for decades to come. In the meantime, seeing what happened in Japan, people around the world became increasingly concerned about the risks of natural disasters, and nowhere are the risks higher than in Tokyo and other Japanese cities.

Such is the context in which confidence in the Japanese economy over the medium to long term suffered a setback. In this article, I will examine Japan’s public finances from the following perspectives: How did the Japanese government get into such poor financial shape? Could fiscal deficits cause Japan to become insolvent? Does Japan, like today’s Greece, pose a sovereign risk problem? And are higher taxes inevitable?

The Warped Shape of the Fiscal 2011 Budget

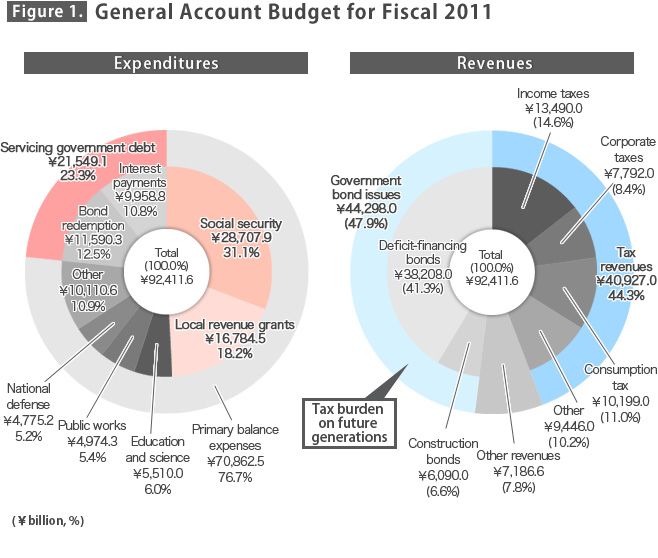

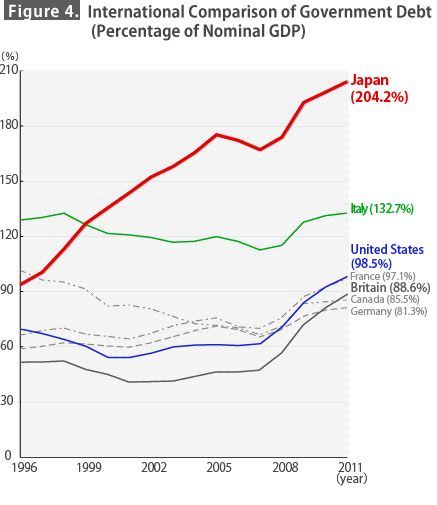

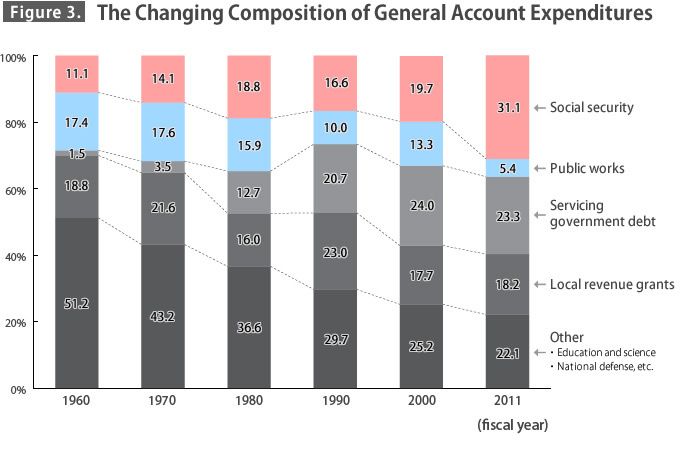

Data on the website of the Ministry of Finance give an overview of the structure of the general account budget for fiscal 2011 (April 2011 to March 2012), which is slightly over ¥92 trillion (*1). Figure 1 provides a breakdown. On the expenditure side, the largest category is social security, accounting for 31.1% of the total. Servicing government debt (interest payments and bond redemption) comes next (23.3%), followed by revenue grants to local governments (18.2%). These three categories together account for 72.6% of all expenditures. So the share of discretionary and policy-related spending is extremely limited.

On the revenue side, 47.9% of the budget is to be covered by issuing government bonds—in other words, by passing the bill to future generations. Tax revenues, at about ¥41 trillion, will cover only 44.3% of spending.

Source: Ministry of Finance data.

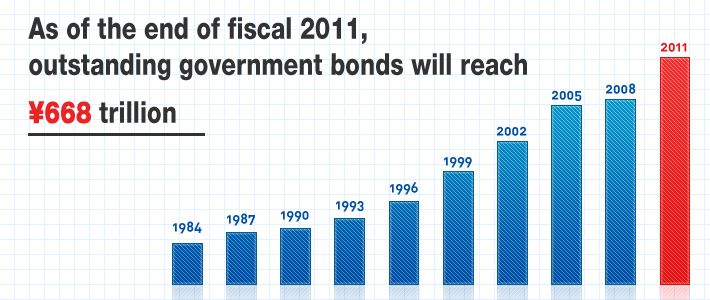

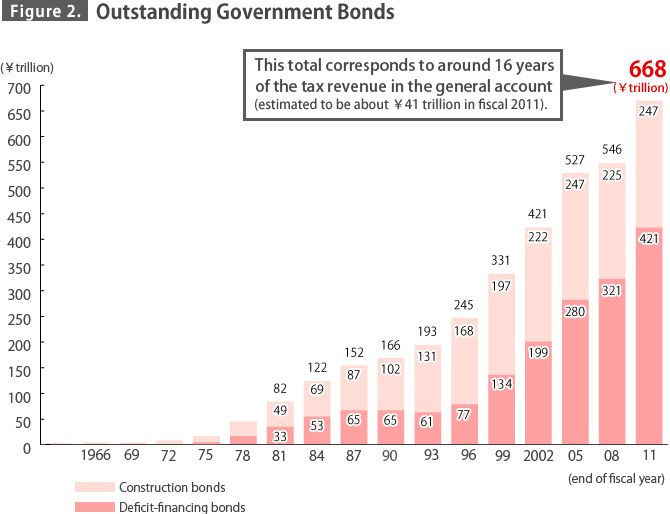

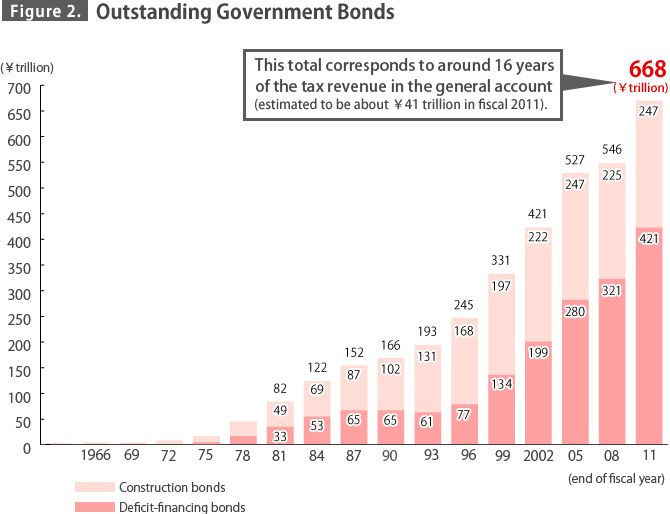

The warped shape of the budget can be seen in this heavier reliance on bonds than on taxes. As of the end of fiscal 2011, outstanding government bonds will reach ¥668 trillion, or 138% of gross domestic product (figure 2). And the combined total of the long-term debts of central and local governments will be on the order of ¥891 trillion (184% of GDP).

In addition to the general account, Japan has 17 special accounts, which are used to implement specified undertakings with revenue from specified sources, such as health insurance premiums and public pension contributions. When the special accounts are added to the general account, the government’s net budget for fiscal 2011 comes to ¥220.3 trillion. The authorities need to improve the transparency of the special accounts by elucidating the relationship between costs and benefits and disclosing the revenues and expenditures for each undertaking.

Source: Ministry of Finance data.

Funding Uncertainties In and After Fiscal 2012

In June 2010 the cabinet approved a fiscal management strategy aimed at securing the health of public finances over the medium term. (*2) It specifies that the administration in fiscal 2011 will make every effort to prevent the issue of new government bonds from exceeding the level of about ¥44 trillion and to hold the expenses in the “primary balance” (revenues minus expenditures, excluding debt-servicing costs and new bond issues) to a maximum of ¥71 trillion, the amount in the fiscal 2010 budget. In order to keep new bond issues at ¥44 trillion, the authorities drew on the “buried treasure” in the special accounts—reserves and surpluses—to come up with the ¥7.2 trillion in the general account’s “other revenues” category.

Difficulties in finding sources of revenue have mounted ever since the change of government in September 2009, when the Democratic Party of Japan moved into power. Arguments over the fiscal 2011 budget focused on pledges in the DPJ’s election manifesto, especially the child allowance and the direct income compensation payments to farmers. Another bone of contention was whether to keep the government’s share of funding for the basic pension, which is designed to cover all residents of Japan, at 50%. The financial mandarins needed to come up with ¥2.5 trillion in funding to maintain this funding as stipulated under the law introduced by the coalition government of the Liberal Democratic Party and New Kōmeitō; and they barely managed to do so by, for instance, drawing on surplus funds held by the independent administrative agency handling such activities as railway construction and reserves in the special account for foreign exchange funds. But there are no promising revenue prospects at all for the budgets for fiscal 2012 and thereafter, which now need to include considerable extra spending for recovery and reconstruction from the March 2011 disaster.

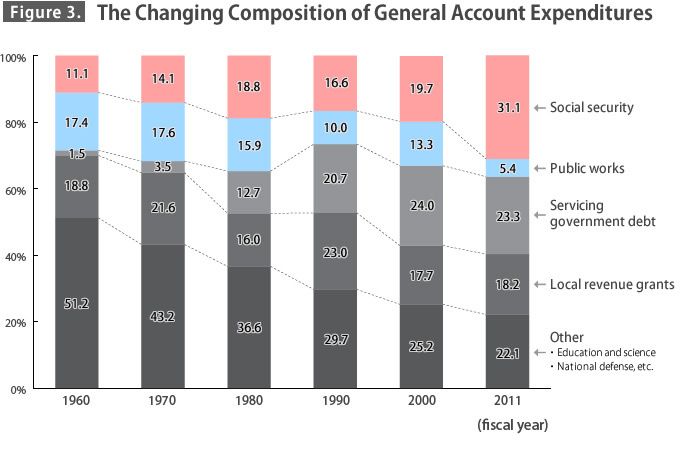

Looking at the expenditure-side causes of the worsening fiscal situation, we find that social security costs are ballooning. As a percentage of all general account spending, they swelled from 16.6% in 1990 to 31.1% in fiscal 2011 (figure 3). At the same time, outlays for public works have been scaled down over recent years. The expense of servicing government debt in fiscal 2011 is expected to fall slightly from a year earlier to ¥21.5 trillion, but that is because interest payments on the bonds should edge down from ¥10.0 trillion to ¥9.9 trillion. They will grow larger in the future if interest rates rise.

Source: Ministry of Finance data.

What Caused Public Finances to Deteriorate?

The fiscal 2010 edition of the government’s Annual Report on the Japanese Economy and Public Finance identifies three causes of the mounting fiscal deficits: (1) Revenue contracted because the nominal growth rate slowed down under unfavorable economic conditions; (2) Interest payments on public debts increased; (3) The government followed a course of lowering taxes and stepping up public investment for policy reasons. (*3)

During the 1990s, the fiscal deficit expanded because of policy factors and economic stagnation. Government spending was boosted to head off a recession when the bubble economy collapsed at the start of the decade. The deficit also grew larger in and after 1999, when business fell into a slump. The government switched course to scaling back public investment after the turn of the century, but social security outlays climbed at a steadily accelerating pace. Meanwhile, the sluggish growth of corporate taxes, which respond sensitively to the business climate, has been a major factor in the shortfalls on the revenue side. In fiscal 2008 even revenue from the consumption tax and other indirect levies, which are supposed to be fairly impervious to swings in the business cycle, fell sharply.

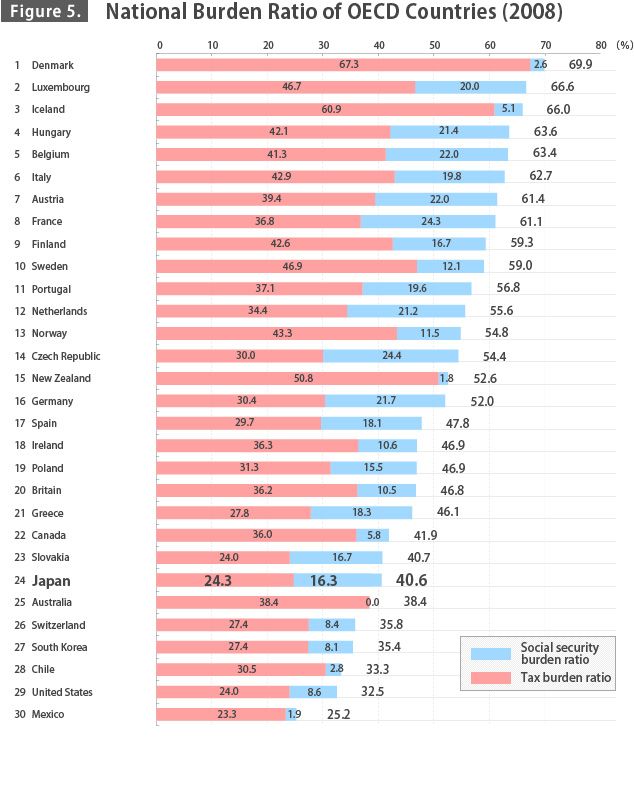

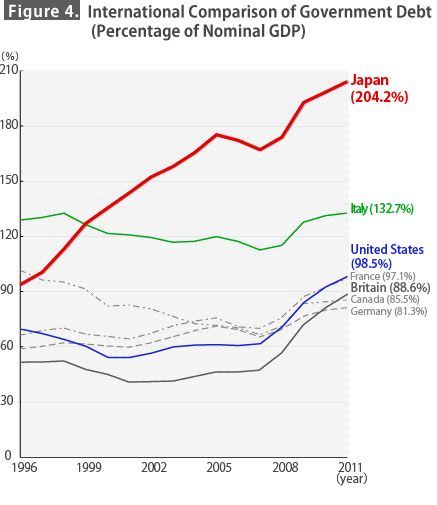

Comparative international data collected by the Organization for Economic Cooperation and Development reveal that Japan’s general government gross financial liabilities, which include long-term government bonds and debts in social security funds, grew larger than GDP in 1997 and went on expanding thereafter, reaching more than twice the size of GDP in 2011. At that level, they are more than double the government financial liabilities in the United States (98.5% of GDP) and Britain (88.6%), and they are considerably larger even than Italy’s (132.7%) (figure 4). (*4)

Source: Ministry of Finance data and OECD Economic Outlook 88 database.

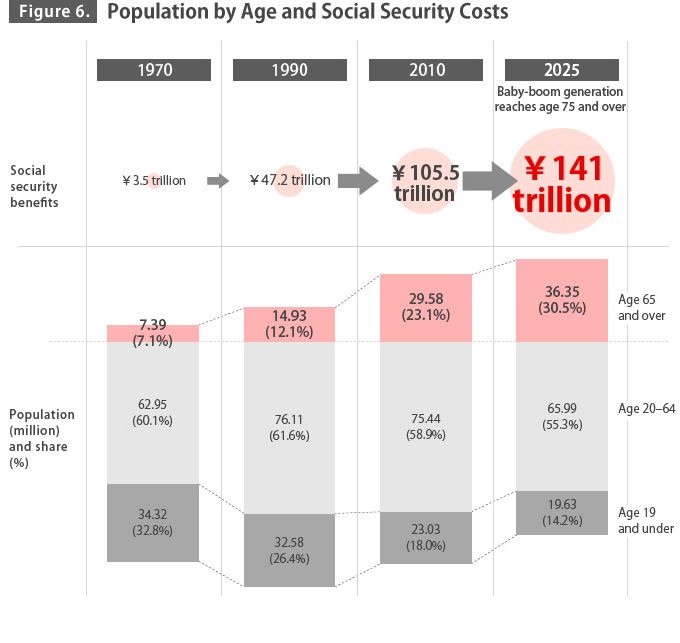

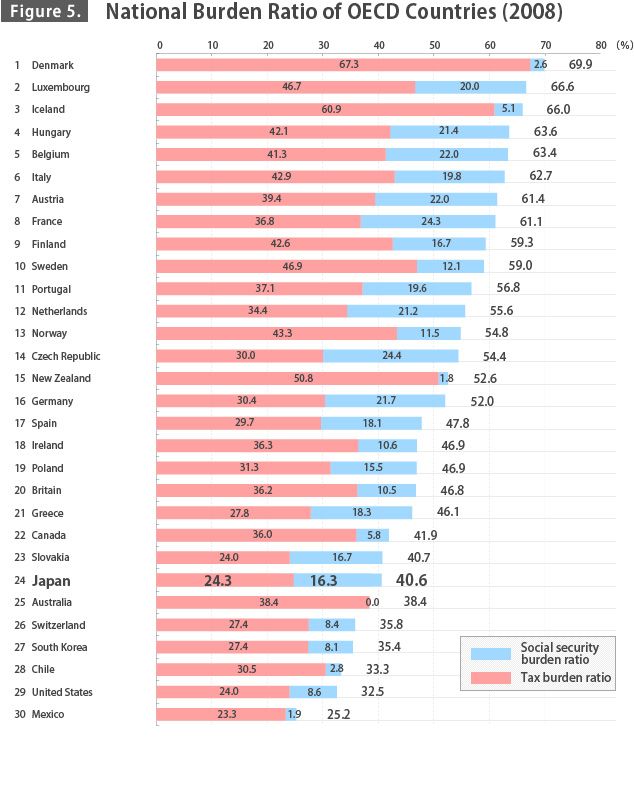

In the United States the administration of President Barack Obama has embarked on a major effort to reduce the red ink in the budget, while Britain under Prime Minister David Cameron is making deep cuts in government spending and imposing a heavier tax load on the public. Japan’s “national burden ratio” (total taxes and social security contributions as a percentage of national income) stood at 40.6% in fiscal 2008, with taxes at 24.3% and social security contributions at 16.3%. This is on the low side among the members of the OECD, well below the figures for Sweden (59.0%) and Germany (52.0%) (figure 5). (*5)

Source: Ministry of Finance data.

Some economists argue that the proper way to compare countries is to look not at gross liabilities but at net liabilities, or in other words, liabilities minus assets. I have my doubts, because some of the assets are items like pension reserves whose future use has already been determined. Even on a net basis, however, Japan’s government financial liabilities stood at 120.4% of GDP in fiscal 2011, higher than the liabilities of any other developed country.

(*3) ^ Cabinet Office, Heisei 22 nendo nenji keizai zaisei hōkokusho (Annual Report on the Japanese Economy and Public Finance 2010), July 2010 [Japanese]. English summary of the report available here.

(*4) ^ Organization for Economic Cooperation and Development, Economic Outlook, no. 88 (December 2010), annex table 32.

(*5) ^ Ministry of Finance, “OECD shokoku no kokumin futan ritsu (tai kokumin shotoku hi)” (National Burden Ratio of OECD Countries [Comparison of National Income]) [Japanese].

The Need for Combined Reform of Taxes and Social Security

According to the set of projections released by the Cabinet Office on January 21, before the earthquake, based on a conservative growth rate assumption of about 1.5%, as of 2020 the deficit in the primary balance of the central and local governments will be ¥23.2 trillion (about 4.2% of GDP). (*6) If the primary balance is to be brought into equilibrium by then, taxes will have to be hiked. The projection found that the goal could be reached by raising the 5% consumption tax, of which each percentage point brings in about ¥2.5 trillion in revenue, by at least 9.3 points. Otherwise, the only choice would be to make drastic cuts in government spending.

If instead a 3% growth rate is assumed until 2020 and the consumption tax is left unchanged, the primary balance deficit will be ¥16.2 trillion (about 2.5% of GDP). The deficit would shrink in this case because tax revenue would grow faster than expenditures. This scenario, however, is wishful thinking, because it posits an unrealistic level of growth and ignores the possibility of revisions in the tax code such as a cut in the corporate tax rate.

A more sensible approach is to seek improvement through a combined reform of taxes and social security. A joint panel of the administration and ruling parties formed to consider social security reform unveiled just such a proposal on June 30. (*7)Its centerpiece is a gradual hike in the consumption tax to 10% by the middle of the current decade. Evidently the DPJ has been forced to accept that taxes will have to be increased. The DPJ government is even finding it hard to maintain 50% government funding for basic pensions as stipulated under the current law, not to mention realizing the goal stated in its election manifesto of securing a “minimum guaranteed pension” fully funded by the government. Another reason that a tax hike is unavoidable is that the government is trying reform the long-term care system and the remuneration medical institutions receive for the treatment they provide.

The problem is that even if the consumption tax is raised to 10%, the prospects will still be bleak for the period from 2015 on. People have also been complaining about the administration because nobody can tell how its current plans relate to the promises the DPJ made in its election manifesto. The recently released reform proposal amounts basically to continuing the policy course set by the previous administration, which was a coalition of the LDP and the New Kōmeitō. It would appear that the current political leadership is thinking about hiking the consumption tax merely as a means to keep the framework of the social security system intact.

The DPJ has yet to get its act together on what to do about the consumption tax. It has been revealed, for instance, that the party members have not even begun discussions on the division of the revenue from a higher tax rate between the central government and local governments. Another issue is the regressive nature of the tax, which bears down most heavily on people in low-income brackets. If the rate is to be hiked, surely thought should be given to making the application of the tax less regressive, but the question has not been raised. The DPJ government is ducking the problems that a higher rate presents, and it is also holding back from making a formal commitment to hiking the tax. By postponing action on such basic questions, the administration has exposed how weak it has become and how little ability it has to formulate policies.

(*6) ^ Cabinet Office, “Keizai zaisei no chūchōki shisan” (Tentative Medium- to Long-Term Calculation of Economy and Finances), January 21, 2011 [Japanese].

(*7) ^ Headquarters of the Government and Ruling Parties for Social Security Reform, “Shakai hoshō, zei ittai kaikaku seian” (Concrete Proposal for Combined Reform of Tax and Social Security Systems), June 30, 2011 [Japanese]. Information in English available here.

The Risk of Fiscal Insolvency

Debts have basically the same meaning whether an individual or a government incurs them. But whereas an individual who borrows from a bank will ordinarily make monthly payments of both interest and principal under a loan contract, when a government borrows by issuing bonds or other securities, it usually just pays interest (the coupon) on the debt at specified intervals and repays the full principal in a lump sum when the security matures.

Government bonds are tendered for bids at posted coupon rates, which are set in accordance with the market yields of the government bonds already issued. These bonds are traded on the open market. When there are numerous buyers, bond prices rise, meaning that the yield declines. Movements in bond prices thus produce changes in yields and influence the government’s interest burden. As can be seen in the Greek debt crisis, which flared up in 2010 and has become critical again in 2011, confidence in the ability of Greece to pay its debts has crumbled, and the view is spreading that the country poses a sovereign risk. Greek government bonds have suffered a downgrading to the status of junk bonds, and the burden of interest payments has grown heavier.

One of the yardsticks used to judge the likelihood of a country’s becoming financially insolvent is an escalating debt burden measured as a share of GDP. If the burden is to be prevented from growing heavier, the country needs to get its primary balance into equilibrium and must achieve nominal GDP growth in excess of the long-term interest rate. Another indicator is the share of government bonds held by investors in other countries. Japan’s share is unusually small, with overseas investors holding only about 6.6% of its bonds. Thanks to the demand for these bonds within Japan, they can be successfully floated even at low interest rates. The money for buying the bonds comes from the large stock of domestic savings. It is estimated that the net financial assets of the household sector are in excess of ¥1 quadrillion. A large portion of this goes through banks into the acquisition of government bonds. But it is also reported that general government financial liabilities now amount to about ¥980 trillion. In short, the domestic market is reaching the limit of its ability to absorb bond issues.

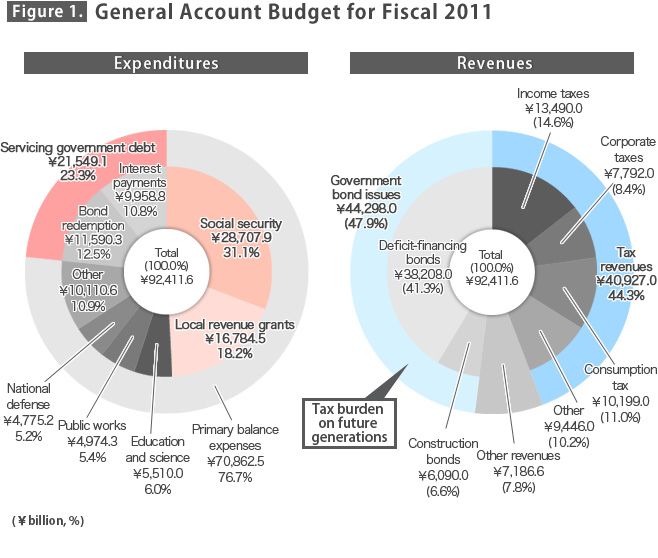

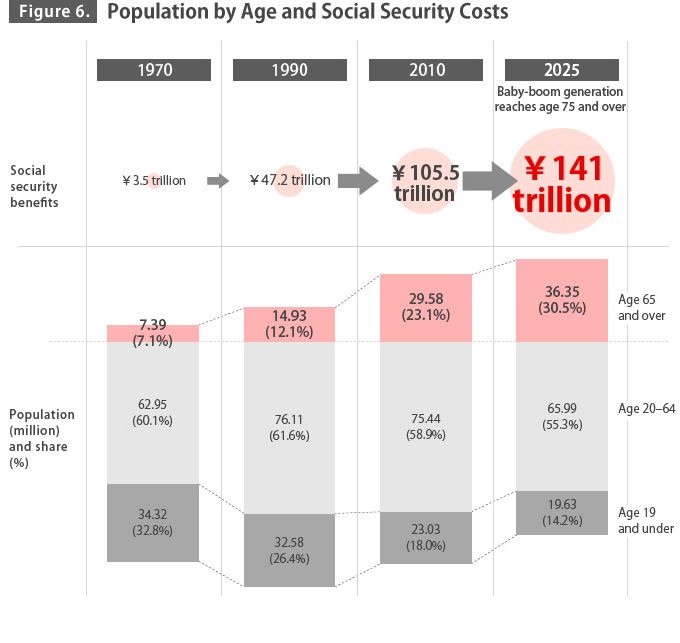

Also of concern is the rapid decline in the household sector’s saving rate, which will lower the share of government debt held by domestic investors. The graying of the population will aggravate the situation. By 2025 the baby-boom generation (those born from 1947 to 1949) will be 75 years of age or older, and social security benefits are expected to reach ¥141 trillion, almost 34% above the 2010 level (figure 6). (*8) As can be understood, further delays in fiscal reform will surely result in a downgrading of Japan’s sovereign debt rating and a rise in long-term interest rates, which in Japan’s case are based on the yield on government bonds. Debt-servicing costs will swell, and public indebtedness will further expand.

Source: Ministry of Finance data.

Note: Baby-boomers are defined as those born from 1947 to 1949.

(*8) ^ Ministry of Finance, “Nippon no zaisei o kangaeru,” op. cit. Information in English available on p. 11 of “Highlights of the Budget for FY2011,” op. cit.

The 3/11 Disaster Darkens the Outlook

On March 11 Japan was hit by a huge earthquake and tsunami, and the disaster was compounded by a nuclear plant accident. The Cabinet Office calculates that the direct damage from the quake and tsunami is on the order of ¥25 trillion, but surely this is an underestimate. And even if we suppose that the losses in capital stock were only ¥25 trillion, future damage in the form of unrealized GDP growth over the next several years will mount to a tremendous sum. It has been estimated that government expenditures for recovery and reconstruction will be about ¥10 trillion per year over the coming 10 years. The poor outlook for public finances will become even bleaker if the state has to bear the financial costs of redressing the damage from the nuclear plant accident and guaranteeing the liabilities of the plant’s owner, Tokyo Electric Power Co.

There are three main options for securing financial resources: (1) reallocating existing expenditures, (2) raising taxes, and (3) issuing government bonds. All are problematic propositions. The first supplementary budget for fiscal 2011 is somewhat larger than ¥4 trillion, of which ¥2.5 trillion was diverted from resources earmarked for the basic pension as a stopgap measure. When the state spends money it has pooled for public pension benefits on other purposes, it is consuming its own assets. The result will be a heavier load on future generations.

Recently there has been talk about securing funds by drawing on the state’s foreign currency reserves, which are on the scale of $1 trillion. At first glance this seems like a fine idea. However, in order to acquire foreign currency reserves, the state raises funds by issuing treasury bills. The reserves are assets denominated in foreign currencies, such as US treasury bills and bonds. If these assets are sold, the first priority will be to redeem the Japanese treasury bills used to acquire them. These reserves are not, in short, a true component of the government’s “buried treasure.” Such techniques as diverting money from the basic pension fund and selling foreign currency reserves amount to a sleight of hand by which the government creates the illusion that it is raising funds without imposing a burden on the public, as it would if it issued government bonds.

In its April 2011 survey of Japan, the OECD offered the following advice: “Achieving the fiscal targets will require tax increases. . . . Revenue should be increased by a comprehensive tax reform that broadens direct tax bases and encourages labour force participation, in part by relying primarily on the consumption tax for additional revenue. To balance the primary budget, the consumption tax rate would have to be raised by five to nine percentage points from its current 5%.” (*9)

Staff members of the International Monetary Fund made a similar suggestion in a report issued on June 16. They said that “a gradual increase in the consumption tax from 5 percent to 15 percent over several years . . . could provide roughly half of the fiscal adjustment needed to put the public debt ratio on a downward path within the next several years.” (*10)

Without waiting for advice from the OECD and IMF, the Japanese government ought to have bravely placed the issue of the social security system’s sustainability before the public, stimulating a debate over costs and benefits and seeking the people’s support. When politicians fail to exercise leadership, the resolution of fundamental problems is delayed. If we Japanese have no hope regarding the political abilities of our own leaders, we ought to consider the possibility of allowing such international organizations to guide the nation forward. We must squarely face the question of how to put our society on a sustainable course. (Written in June 2011)

(Originally written in Japanese by Nariai Osamu, Professor at Reitaku University.)