Revenue from Japan’s Hometown Tax System Tops ¥1 Trillion for First Time

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

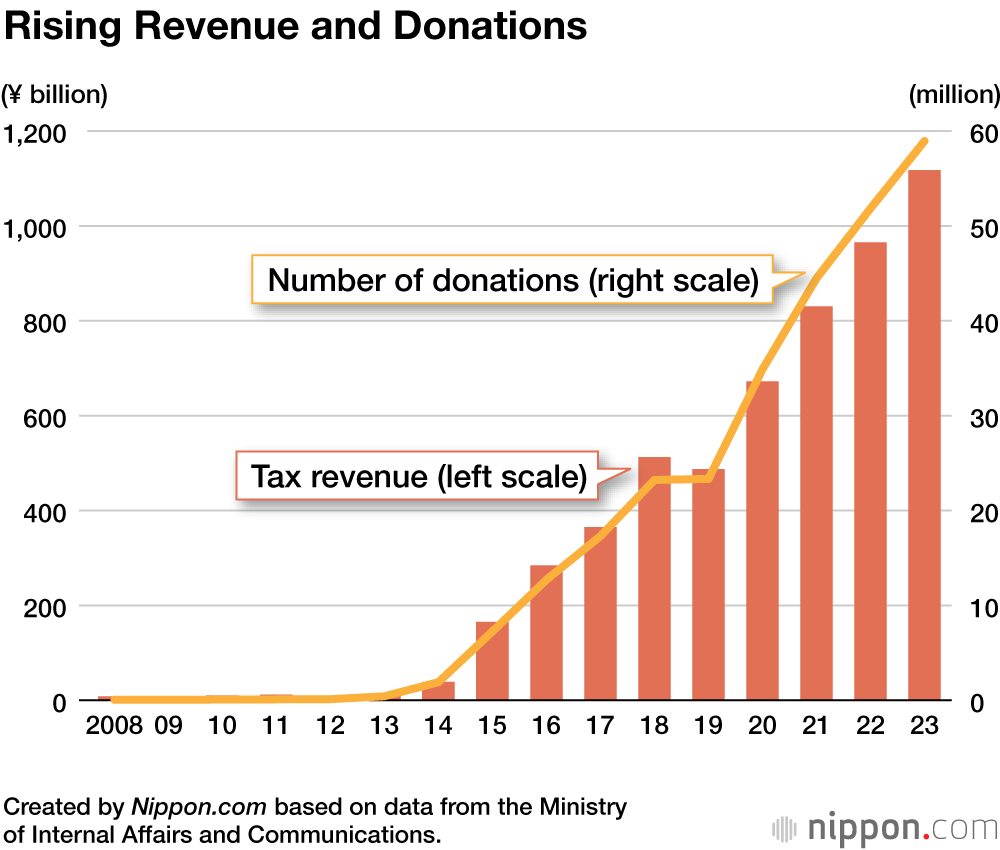

The Ministry of Internal Affairs and Communications announced that the amount of donations to Japan’s furusato nōzei hometown tax system in fiscal 2023 increased by 16% over the previous year to ¥1.11 trillion, setting a record high for the fourth consecutive year. The number of donations also reached a record high, increasing year on year by 14% to 58.9 million, while the number of people making donations climbed over 10 million for the first time.

The furusato nōzei hometown tax scheme was introduced in 2008 as a way to even out the disparity in tax revenue between urban and rural areas. By making donations to municipalities where they do not live, taxpayers can receive deductions in their income and resident taxes equal to the same amount minus ¥2,000. Donors also receive gifts of specialty items from municipalities in return for their donations.

After its launch, the system soon became better known as a way of obtaining special gifts than as a means of contributing to the financial wellbeing of local municipalities, with many donation recipients offering high-end items like brand-name wagyū or seafood. Portal sites that manage transactions started giving points to attract users, further boosting the popularity of furusato nōzei.

The municipality that received the most donations in fiscal 2023, totaling ¥19.4 billion, was Miyakonojō in Miyazaki Prefecture, which provides gifts like Miyazaki beef and sweet-potato shōchū. In second place, at ¥19.2 billion, was Monbetsu in Hokkaidō, which offers gourmet treats such as crab and salmon roe, followed by Izumisano in Osaka Prefecture, with items that included processed meat and towels bringing the city ¥17.5 billion in donations.

The hometown tax system does not benefit all cities equally, though, with some municipalities suffering outflows of tax revenue due to the number of residents making use of furusato nōzei. The municipality that saw the greatest loss of revenue, at ¥30.5 billion, was Yokohama (Kanagawa Prefecture), followed by Nagoya (Aichi) at ¥17.7 billion, Osaka (Osaka) at ¥16.7 billion, Kawasaki (Kanagawa) at ¥13.6 billion, and Tokyo’s Setagaya at ¥11.0 billion. All of these are either designated cities under the Local Autonomy Act or Tokyo municipalities. While their large populations generate a lot of tax revenue, the cities also have large budgets to cover the many services they provide residents, which may be affected by the outflow.

From October 2025, the MIC will ban donations via websites that offer points in an attempt to curb excessive competition.

(Translated from Japanese. Banner photo © Pixta.)